The year is beginning with a lot of anxiety about a potential recession, stock market crash, and more bank failures. But, let’s hand it to Wall Street.

The S&P 500 was up more than 21% by the end of 2023.

Cause for Celebration?

Given the Fed’s innumerable interest rate hikes and investor anxiety over economic uncertainty, it’s remarkable that the S&P finished as strong as it did.

But, instead of celebrating, it’s actually unsettling news to investors.

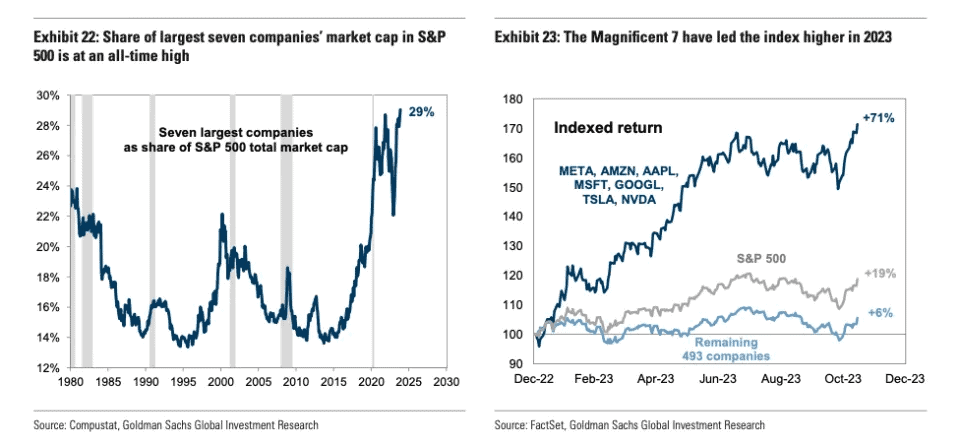

As it turns out, the S&P’s impressive performance is due to just a handful of stocks, known as the Magnificent Seven.

Together, Apple, Amazon, Alphabet (Google), NVIDIA, Meta, Microsoft, and Tesla were up around 70% by end of 2023.

If you take them out of the S&P 500, the index would only be up around 6% (not adjusted for inflation).

The S&P 500 has never been this top-heavy in its 101-year history.

This is why investors are nervous.

Over-dependence on just seven stocks can be risky, leaving retirement accounts vulnerable to a downturn if the Magnificent Seven were to falter.

Those Who Do Not Learn from History Are Doomed to Repeat It

History does not paint a rosy picture for companies dominating the S&P 500.

In the 80’s, IBM, AT&T, and oil and gas companies dominated the S&P 500 Top 10. By the 90’s, only one oil company (Shell) remained.

By 2000, only two companies (Exxon and GE) from the 80’s remained.

By 2023, only one company from the 2000’s (Microsoft) remained and not one company from the 80’s was on the list.

If history is an indication of things to come, how confident are you that the Magnificent 7 companies will still be around?

And, if they go, what will happen to your investment and retirement accounts?

How to Weather the Storm

Recession or something worse like a stock market crash would be incredibly painful because most investors own stock in the Magnificent Seven.

In fact, many well-respected financial services companies (Wells Fargo, TD Securities) believe that a recession is, indeed, coming in 2024.

It’s important to stay informed and learn the lessons that history has repeatedly taught us.

By diversifying your IRA or 401(k) away from being too top-heavy in any one specific asset class, and engaging in prudent financial planning, individuals can navigate these turbulent waters and position themselves for financial success in an ever-changing world.

As we collectively deal with these challenges, one constant remains: the importance of informed decision-making in the pursuit of financial well-being.

Sources

- https://finance.yahoo.com/news/one-chart-shows-how-the-magnificent-7-have-dominated-the-stock-market-in-2023-203250125.html

- https://www.opb.org/article/2023/12/13/wall-street-calls-them-the-magnificent-7-they-re-the-reason-why-stocks-are-surging/

- https://www.marketsentiment.co/p/the-problem-with-magnificent-7

- https://www.nasdaq.com/articles/will-there-be-a-recession-in-2024-heres-what-economists-predict

Custom Precious Metals IRA

Custom Precious Metals IRA Gold IRA

Gold IRA Gold Products

Gold Products Silver Products

Silver Products Platinum

Platinum