The CDC’s plan for struggling Americans falls strikingly short of the Federal Reserve’s instant outpouring of monetary support for Wall Street.

As some Americans are slowly making their way back into their office from furloughs, 30 Million Americans are still out of work and facing evictions or foreclosures with little help from the government.

We’ve seen this happen once before between 2007-2010. While Wall Street often paints a pretty picture of the economy’s resurgence, in actuality it is not entirely so.

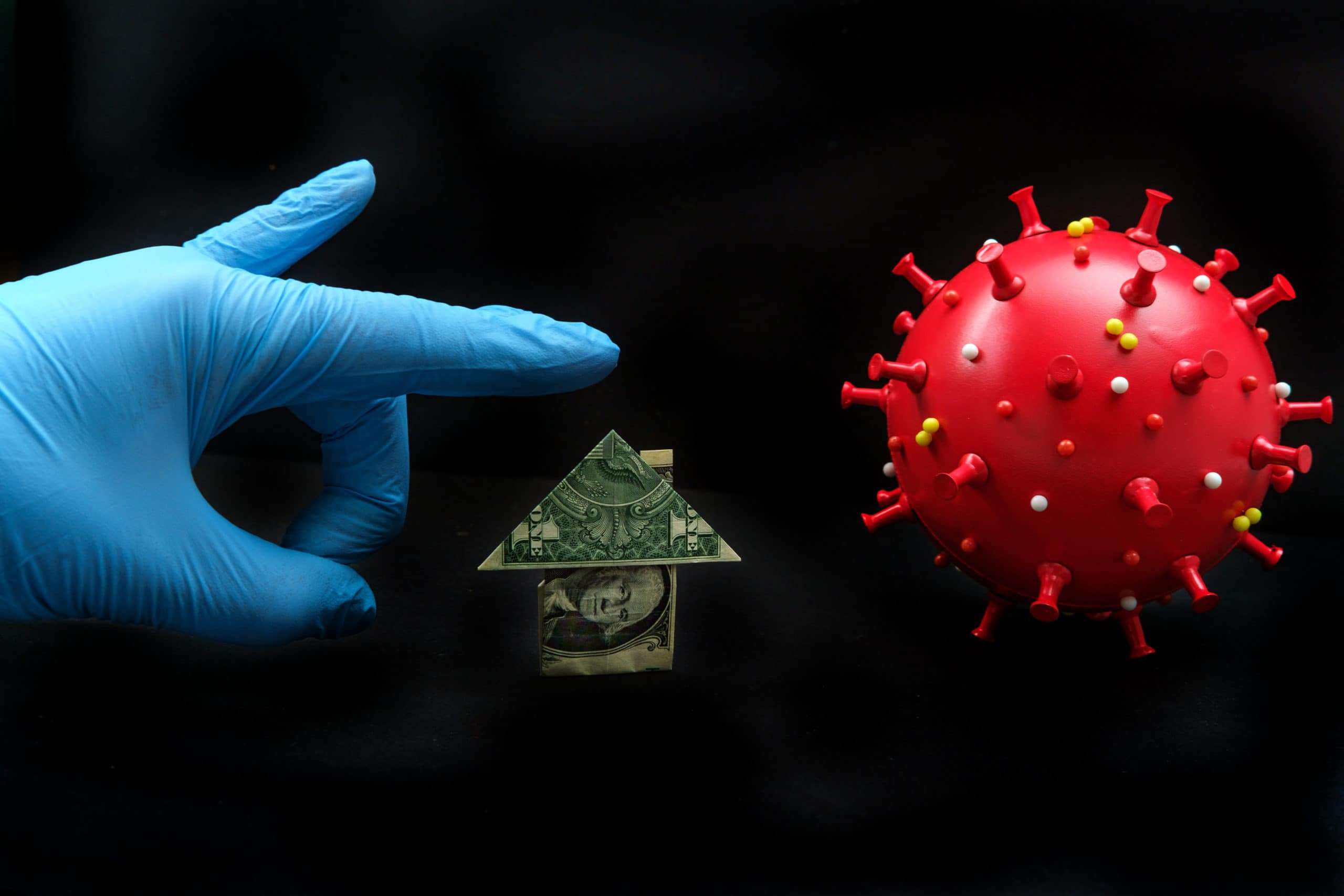

At this point, we’re all well aware the economy is on a fast decline but as we’re seeing the effects of its downhill spiral, accompanied by Covid-19’s increasing impact our daily lives, we need to come to terms with the severity of the situation and realize it’s up to us to protect our own wealth and assets.

The following is taken from a recent article by Pam Martens and Russ Martens, from September 3, 2020 ~

Tens of millions of struggling Americans have been set up to fail as the one percent on Wall Street, propped up by unlimited money from the Fed will be ringing in the New Year come to the end of the year.

According to a recent study published by The Aspen Institute, 30 to 40 million Americans will be at risk of eviction over the next several months.

The Centers for Disease Control and Prevention (CDC) has been dragged into the eviction process due to Democrats’ and Republicans’ inability to find common ground on a meaningful plan.

The plan has a multitude of defects, including the following:

(1) It’s more of a Disney-themed band-aid instead of a plan. It lasts for just four months to December 31, 2020.

(2) It provides no monetary assistance to help the renter pay the piling up the rent on December 31 – effectively guaranteeing eviction at the start of the year in millions of cases.

(3) It provides no assistance to the small landlord who may be facing foreclosure because he can’t pay his own mortgage on the building. According to a recent study published by The Aspen Institute, “mom and pop landlords own 22.7 million out of 48.5 million rental units in the housing market, more than half (58%) do not have access to any lines of credit that might help them in an emergency.”

(4) It provides no help to out-of-work homeowners who are facing foreclosure. On June 29, the Democrat-controlled House of Representatives passed the Emergency Housing Protections and Relief Act of 2020 that provides $100 billion for emergency rental assistance programs and a $75 billion relief fund for homeowners. The Republican-controlled Senate has refused to pass the legislation.

(5) It does nothing to stop landlords from evicting tenants (who can’t afford a lawyer to challenge the eviction) on dubious charges of loud noise, damage to the premises, or other potentially false claims.

The CDC’s plan for struggling Americans falls strikingly short of the Federal Reserve’s instant outpouring of monetary support for Wall Street for the second time in 12 years. In the first iteration, which lasted from December 2007 to July 2010, the Fed pumped $29 trillion cumulatively in revolving loans at below-market rates to prop up insolvent or teetering banks and trading houses on Wall Street. The crisis was of Wall Street’s own making by creating toxic derivatives and subprime mortgage products.

The $29 trillion in Fed loans were made without the approval, or even awareness, of Congress. That aid to Wall Street came as millions of Americans saw their homes foreclosed on by the same banks receiving the handouts from the Fed.

September 17, 2019, marked the beginning of yet another self-inflicted financial crisis on Wall Street. Sparked by a liquidity crisis in the overnight lending market (repo loans) interest rates spiked from 2 percent to 10 percent. The Fed jumped in with both feet to force rates back down. The Fed’s own minutes reveal that it was providing “roughly $215 billion per day” to the trading houses on Wall Street.

Once the pandemic entered the picture, the Fed opened its money spigot to Wall Street even wider, setting up 11 additional bailout programs.

Despite the worst potential eviction crisis facing Americans since the Great Depression, the only comprehensive analysis of the problem that we have seen has not come from the Trump administration but from outside scholars. Following are just some of the critical findings of the in-depth study on “The COVID-19 Eviction Crisis” published at The Aspen Institute:

“Renters experiencing cash shortages are increasingly relying on sources other than income to pay rent. Thirty percent of renters report using money from government aid or assistance to pay rent, and another 30% indicate that they have borrowed cash or obtained a loan to make rental payments…

“Tenants are increasingly using credit cards to pay the rent, with a 31% increase between March and April, an additional 20% increase from April to May, and a 43% increase in the first two quarters as compared to the prior year…

“There is increasing evidence that families are shifting their budget towards rent. Food pantry requests have increased by as much as 2000% in some states, with nearly 30 million Americans reporting they do not have enough food…

“In the first month of the pandemic, the federal government instituted a limited moratorium on evictions in federally-assisted housing and for properties with federally backed mortgages. The federal eviction moratorium protected about 30% of renters. Various actors in forty-three states and the District of Columbia issued eviction moratoriums that varied in level of protection and the stage of eviction stopped. Those state-level protections ranged from a few weeks to a few months in duration and did not apply to all evictions. Federal protections expired on July 24th. As of July 31st, 30 states lack state-level protections against eviction during the pandemic…

“In an updated analysis of the US Census Bureau’s Pulse Survey, based on renter’s perceptions of their ability to pay, the Aspen Institute Financial Security Program and the COVID-19 Eviction Defense Project currently estimate that 29 million renters in 12.6 million households may be at risk of eviction by the end of 2020. Stout anticipates that up to 40 million people in more than 17 million households may be at risk of eviction through the end of the year when considering a portion of survey respondents who have a ‘moderate’ degree of confidence in the ability to pay rent (in addition to those with slight or no confidence)…

“The most comprehensive policy proposals include a nationwide moratorium on evictions and at least $100 billion in emergency rental assistance. Combining this assistance with an extension of federally enhanced unemployment insurance for displaced workers would provide additional relief for renters. Responses like these could neutralize the eviction risk outlined in this report, eliminating the public and private costs of mass evictions that result from the pandemic. More importantly, they could prevent millions of people in America from experiencing unfathomable hardship in the months and years ahead. These solutions have passed the US House of Representatives two times, and have companion legislation in the Senate.”

As the fed will continue to pour money into Wall Street, the dollar will continue to decline, losing its buying power, which may lead to a bank collapse as it did in the 2008 crash. Americans are no longer willing to sit back and watch their hard-earned savings dissipate. They’re taking action to safeguard their retirement and wealth by diversifying their portfolios with proven commodities.

Precious metals have been known to retain and exceed their values over the years, making them the perfect portfolio hedge for many investors. Gold has increased 30% in value in the past 6 months alone, while silver doubled in value at that same time. As a long term investment, we can’t help but notice Gold has skyrocketed 250% since the 2008 economic collapse and has gained recent notoriety from the likes of highly regarded billionaires like Warren Buffett, who recently exited banks in favor of Gold.

It’s no surprise investors are moving their money into precious metals. Not only does it make for a simple and efficient rollover if you currently have an IRA or 401K but it’s a tax -free. While some prefer to hedge their stock-based and paper-asset portfolios with a proven commodity like gold, others prefer to own the physical asset outright knowing they can easily liquidate it at any time. That type of security and assurance is clearly worth its weight in gold.

Custom Precious Metals IRA

Custom Precious Metals IRA Gold IRA

Gold IRA Gold Products

Gold Products Silver Products

Silver Products Platinum

Platinum