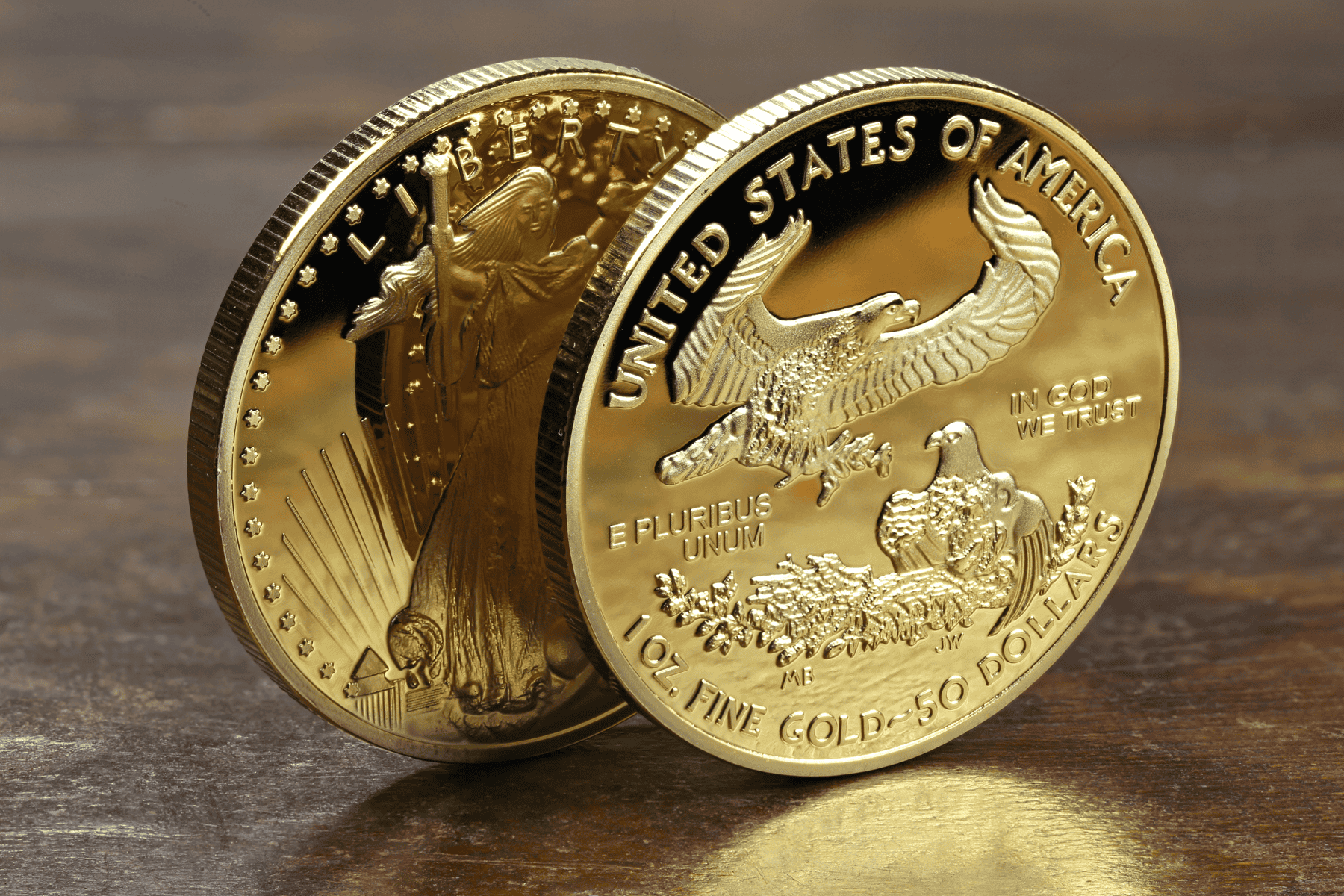

Gold has recently surged past the $2,500 mark, breaking records and signaling significant economic shifts. This milestone reflects increasing economic uncertainty, persistent inflation, and global geopolitical tensions. The weakening of…

Gold has recently surged past the $2,500 mark, breaking records and signaling significant economic shifts. This milestone reflects increasing economic uncertainty, persistent inflation, and global geopolitical tensions. The weakening of…

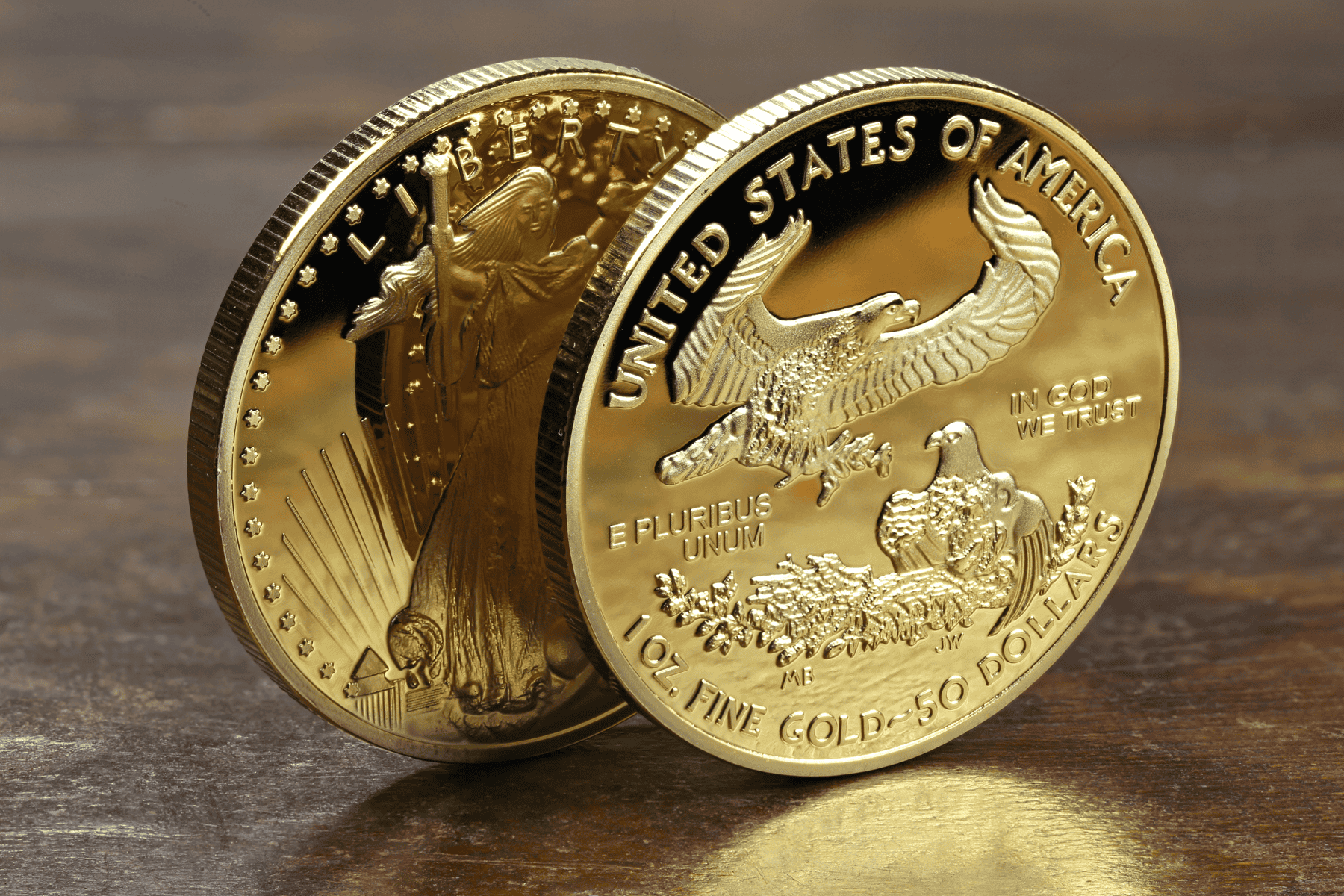

Why Central Banks are Increasing Gold Reserves and Why You Should Too Gold has always been a symbol of wealth, security, and stability. Its allure transcends cultures and centuries, making…

Has the Political Race Changed? As we approach Election 2024, the landscape seems as tumultuous as ever. With one incumbent president stepping aside and a former president still in the…

As investors and analysts scramble to fully understand the reasons behind this sudden market downturn, many are re-evaluating their portfolio strategies.

After the fall of the tech-bank-Titan SVB, other banks are forecasting a troubling future. This blog aims to explore why the banks are failing, what this could mean for the economy, and how individuals can protect their financial holding during times of economic instability [buying liquid assets that retain their value… like gold].

Are you thinking of investing in gold? According to reports from the WEC, the world is at a point of significant economic danger. Gold has long been considered a safe haven asset,…