13 Retirement Mistakes to Avoid and How to Protect Your Wealth with Smart Diversification Planning for retirement is one of the most significant financial undertakings of your life. While…

13 Retirement Mistakes to Avoid and How to Protect Your Wealth with Smart Diversification Planning for retirement is one of the most significant financial undertakings of your life. While…

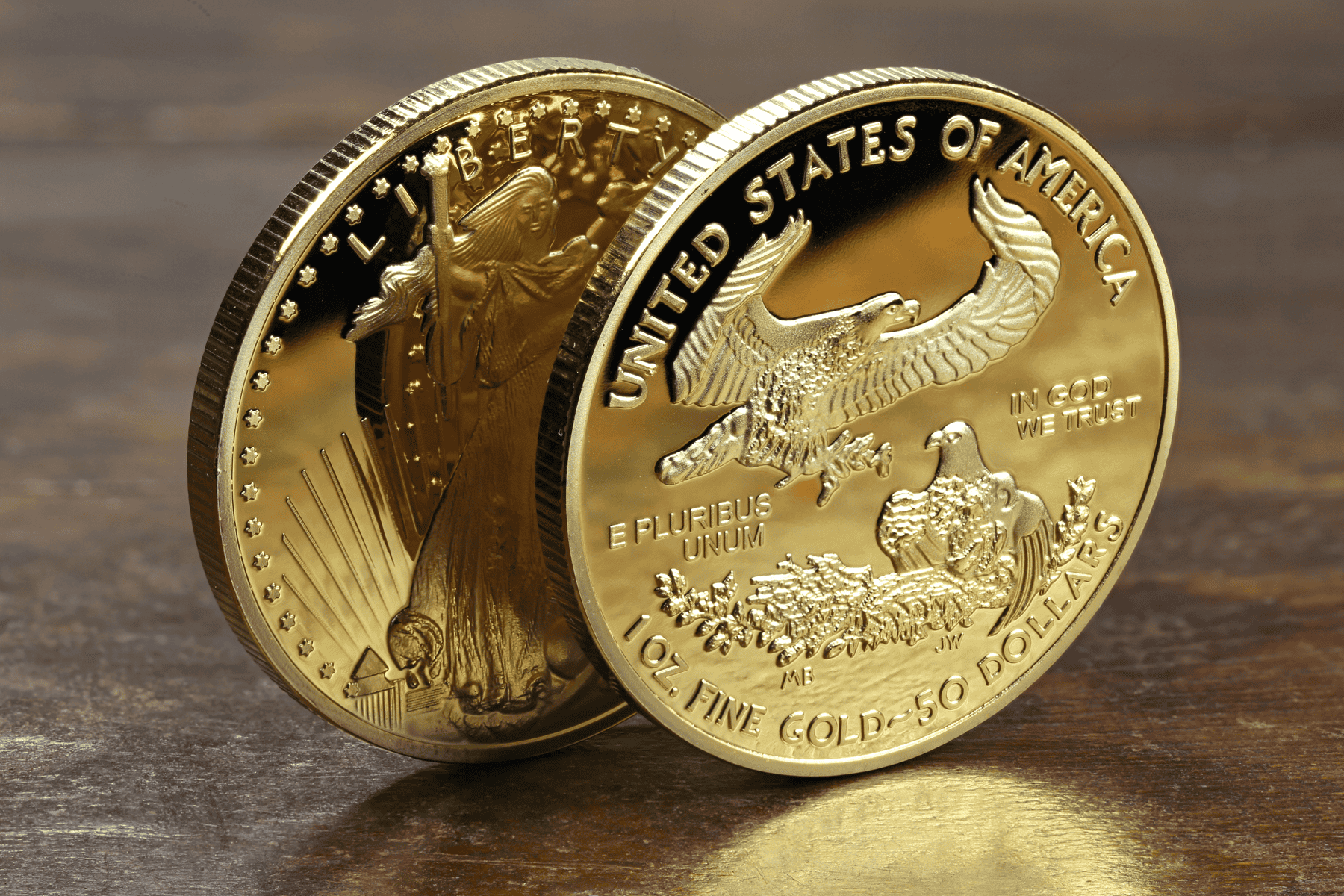

Gold: A Strategic Asset in a Post-Election Economic and Political Landscape No single asset can promise complete security, but gold has a proven track record of maintaining its value in…

Gold and silver have captivated humanity for centuries, symbolizing wealth, security, and stability. Yet, despite their proven track record, many investors hesitate to act when opportunities arise, often succumbing to…

How Top Investors Turn Gold and Silver Into Wealth Creators Gold and silver have long been considered safe havens during economic uncertainty. But for savvy investors, these precious metals are…

The Evolution of the Dollar and the Rise of De-Dollarization: Why Gold and Silver Matter More Than Ever In recent years, concerns around the stability of the U.S. dollar and…

The Final Thoughts: Hope for the Best, Prepare for Reality As Trump re-enters office, investors may feel optimistic about an economic turnaround. However, the weight of rising debt, inflationary pressures,…

Trump’s Return: High Hopes vs. Economic Realities With Trump back in office, many Americans anticipate a resurgence of economic policies that will restore growth and prosperity. However, Trump’s administration now…

Gold prices have reached historic levels with a recent high $2750 per oz. If you have been thinking about purchasing Gold or Silver, now is the time to understand how…

Gold has recently surged past the $2,500 mark, breaking records and signaling significant economic shifts. This milestone reflects increasing economic uncertainty, persistent inflation, and global geopolitical tensions. The weakening of…

Why Central Banks are Increasing Gold Reserves and Why You Should Too Gold has always been a symbol of wealth, security, and stability. Its allure transcends cultures and centuries, making…