Introduction

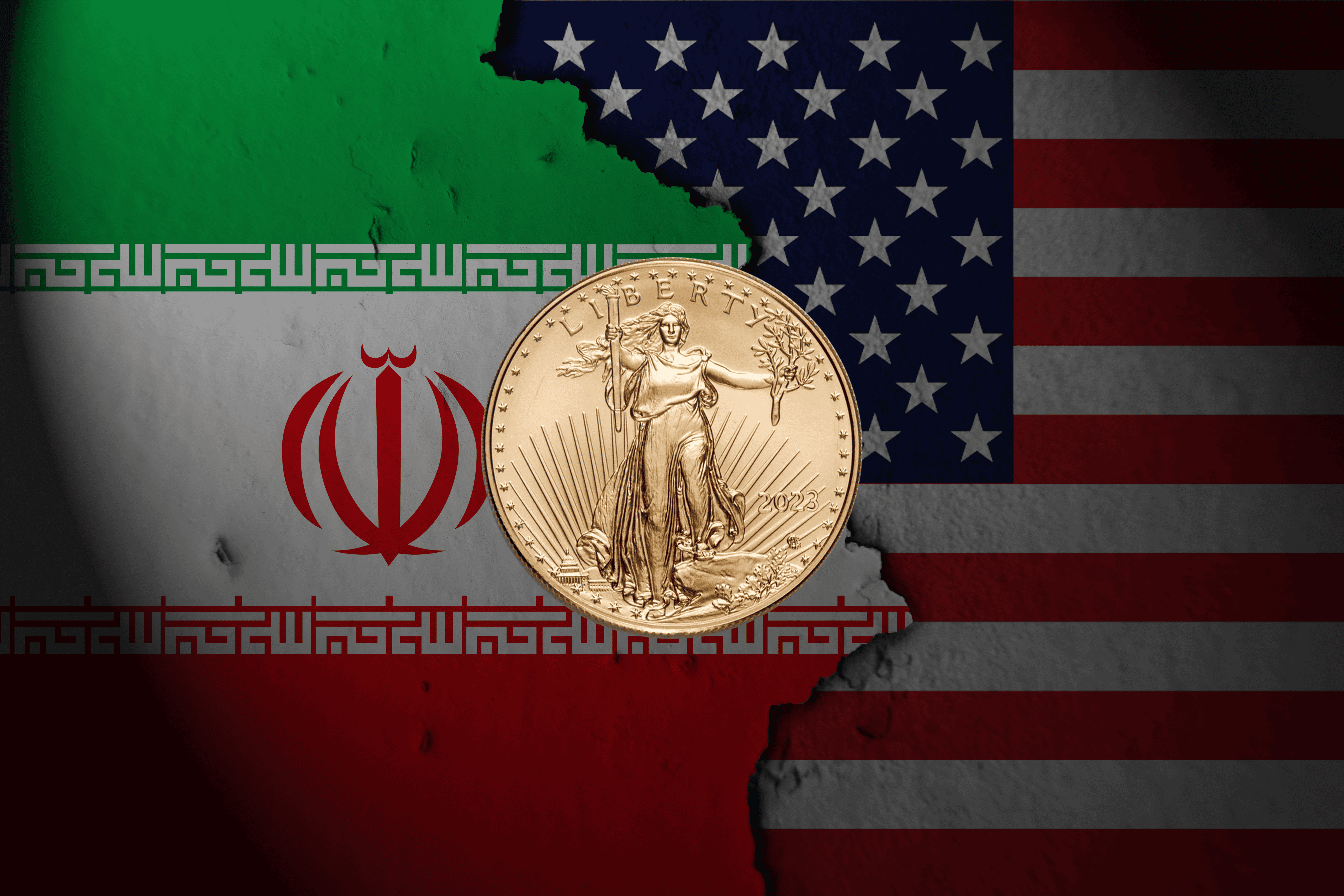

As geopolitical tensions escalate across the Middle East—especially with renewed focus on Iran—the financial world is taking notice. For decades, precious metals like gold and silver have played a crucial role in global finance, particularly during periods of uncertainty. As concerns grow around potential military conflict, many institutional and individual investors are reevaluating the role of metals in a diversified portfolio.

1. Why Geopolitical Risks Drives Precious Metals Demand

Historically, times of geopolitical instability have coincided with increases in gold prices. From the Cold War and Gulf War to the more recent Russia–Ukraine conflict, gold has acted as a potential safe haven during market volatility.

Ongoing tensions in the Middle East—especially with the possibility of conflict involving Iran—raise several economic and market concerns:

✅ Disruption of oil supply chains leading to inflation.

✅ Regional instability affecting trade and diplomacy.

✅ Currency and market pressures due to sanctions or retaliation.

In such environments, investors often look to gold to reduce exposure to volatile currencies and unpredictable financial markets.

2. A Potential Surge in Precious Metals Pricing

While no one can predict commodity prices with certainty, history shows that geopolitical shocks often spur demand spikes that drive metals prices upward.

✅ Safe-Haven Buying: Investors seek gold and silver as protection against systemic risk.

✅ Currency Hedging: Metals serve as value anchors during periods of currency devaluation.

✅ Institutional Activity: Central banks and sovereign wealth funds increase their holdings during times of macro risk.

These conditions could fuel renewed interest in physical gold and silver, especially if tensions intensify or inflation fears grow.

3. Strategic Appeal of Gold in a Global Context

Beyond crisis moments, there’s a growing global trend: countries are stockpiling gold to support long-term diversification and political independence.

✅ No Counterparty Risk: Physical gold avoids exposure to third-party default.

✅ Global Liquidity: Gold is universally tradeable and retains value in most markets.

✅ Government Policy Hedge: Gold can protect against sudden capital controls or financial policy shifts.

4. Central Bank Behavior as a Market Signal

According to the World Gold Council and IMF, central bank gold purchases surpassed 1,000 tonnes in both 2022 and 2023. This trend has continued in 2025, led by countries with complex geopolitical profiles, including China, Turkey, and India.

This large-scale movement signals an institutional belief in gold’s value during global turbulence. For private investors, the message is clear: if governments are hedging with gold, should individuals consider doing the same?

5. Silver, Platinum & Palladium: The Ripple Effect

While gold leads the headlines, other precious metals also respond to geopolitical uncertainty:

✅ Silver is a lower-cost hedge with demand from tech and solar sectors.

✅ Platinum and Palladium are key to automotive and industrial production, and sensitive to supply chain disruption.

These metals may see increased demand if conflict triggers global trade instability.

6. What It Means for Your Wealth Strategy

No one can control geopolitics, but smart investors can prepare.

Precious metals provide a historically proven tool for:

✅ Diversifying away from traditional equities or fiat-heavy holdings.

✅ Hedging against inflation, war, or sanctions.

✅ Preserving long-term purchasing power.

Final Thoughts: Navigating Global Uncertainty with Confidence

Rising tensions with Iran are part of a broader pattern of global instability. Investors who stay informed and proactive are better positioned to protect their wealth.

At Allegiance Gold, we help clients explore how physical gold and silver may strengthen a long-term financial strategy. Our commitment is built on education, transparency, and trusted guidance—especially in uncertain times.

📚 Sources:

-

World Gold Council – Central Bank Gold Demand Reports (2022–2025)

-

International Monetary Fund Reserve Trends, Q2 2025

-

U.S. Department of State Geopolitical Risk Briefings, 2025

-

Bloomberg Precious Metals Markets Overview, June 2025

- S&P Global Historical Asset Correlations, 2000–2024

Disclaimer:

Allegiance Gold is not a registered investment advisor or broker-dealer. This content is intended for educational purposes only and does not constitute financial, legal, or tax advice. Past performance is not indicative of future results. Please consult your financial advisor before making investment decisions.

To Start Your Gold IRA Today:

Download Your Free Gold IRA Guide | Open Your Gold IRA Account | Book Your Consultation

Protect your financial future with Allegiance Gold an Inc 5000 company– Your trusted partner in Gold and Silver IRA investments.

|

|

Buy Now |

Buy Now |

Act now and join the millions who trust gold to secure their wealth.

Gold Products

Gold Products Silver Products

Silver Products Platinum

Platinum