Introduction

Over the past year, gold and silver have captured unprecedented attention from investors and market watchers alike. Silver recently crossed the $100-per-ounce threshold, while gold flirted with record levels above $5,000 per ounce. While these numbers may seem dramatic, they reflect deeper shifts in global financial markets—shifts driven by rising debt, changing interest rates, and growing uncertainty over the stability of fiat currencies.

It’s easy to see silver’s move as a story of industrial demand. The metal is essential in electronics, solar panels, and other high-tech applications, and rising investor interest has amplified price gains. But gold, unlike silver, often signals something broader: a rising awareness of risk in financial systems. When gold moves sharply higher, it’s often a warning light flashing for the global economy.

Japan: A Debt Problem of Historic Proportions

At the heart of recent market turbulence is Japan, which carries the world’s largest debt-to-GDP ratio at roughly 260%. For years, the Bank of Japan maintained extraordinary control over the country’s borrowing costs through yield curve control. In simple terms, this meant buying massive amounts of government bonds to keep interest rates extremely low, ensuring that debt service costs remained manageable.

That era appears to be ending. Long-term Japanese government bond yields, particularly the 30-year maturities, have climbed sharply from near 0.7% in 2022 to around 3.6% today. On the surface, this may not seem catastrophic, but for a nation with such an immense debt load, higher yields can become a snowballing problem. Interest payments could rise dramatically, forcing either higher taxes, increased borrowing, or significant monetary intervention.

In other words, Japan’s carefully controlled financial experiment is showing signs of stress. And because Japan is the world’s third-largest economy and its currency—the yen—is a major global reserve currency, the implications extend far beyond Tokyo.

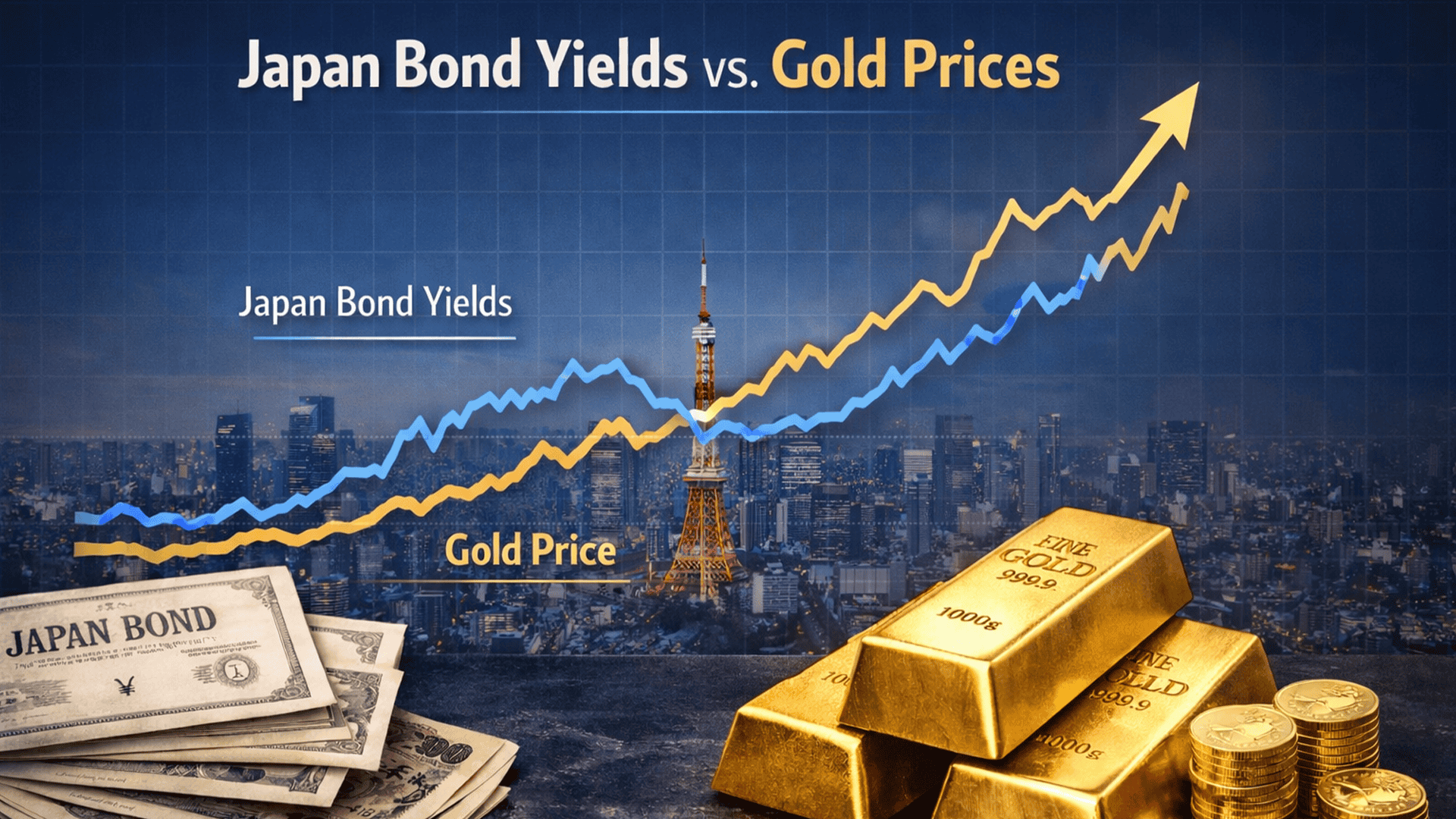

The Unexpected Link Between Japanese Bonds and Gold

What may surprise some investors is how closely Japan’s bond market is tracking gold prices. At first glance, these appear to be unrelated assets—one is a government debt instrument, the other a precious metal. But the connection lies in the global role of the Japanese yen and the mechanics of international finance.

For decades, traders have used the yen in a strategy known as the “carry trade.” Because Japanese borrowing rates have been so low, investors could borrow yen cheaply, convert it into dollars, and invest in higher-yielding assets like U.S. stocks, bonds, or commodities. This trade has fueled markets for years.

As Japanese yields rise, however, borrowing costs increase, making these trades less profitable. The unwind of such positions can create ripple effects in multiple markets, including equities, bonds, and commodities. At the same time, investors often seek safety in gold during periods of financial stress. Rising Japanese yields, therefore, are indirectly supporting higher gold prices, illustrating how interconnected today’s global financial system really is.

Japan’s Debt and the Global Implications

Japan has long been cited as proof that extremely high debt levels are sustainable. Economists and policymakers have often pointed to Japan’s 260% debt-to-GDP ratio as a counterexample to warnings about rising deficits elsewhere. After all, if Japan can manage such debt for decades, why should U.S. debt at 128% of GDP or European debt at similar levels be concerning?

History, however, suggests caution. Nations rarely sustain enormous debt indefinitely without encountering currency crises, inflation, or financial instability. Japan’s recent struggles with rising yields may be the first clear sign that even the most debt-tolerant nations can hit limits. If Japan starts to face a serious debt servicing problem, it could challenge the prevailing assumptions about global debt sustainability and ignite broader market volatility.

Gold and Silver: Safe Havens in Uncertain Times

Amid these developments, physical gold and silver continue to attract investors as hedges against risk. Unlike government bonds or fiat currencies, these metals cannot be created at will. They have historically served as stores of value during periods of financial stress, inflationary pressure, or currency instability.

Several factors are contributing to higher demand for physical gold and silver today:

- Rising central bank holdings: Many central banks are buying gold to diversify their reserves and reduce reliance on the U.S. dollar.

- Currency risk: With global debt levels rising and fiat currencies under pressure, investors are turning to assets that preserve value independent of government policy.

- Geopolitical uncertainty: Political instability and international tensions encourage demand for tangible assets that cannot be frozen, seized, or devalued.

Physical ownership provides unique advantages over paper or digital representations of precious metals. When you hold bullion, coins, or bars, you own an asset outside the traditional banking and financial system. It is fully under your control, accessible in times of crisis, and immune to counterparty risk.

Silver’s Industrial and Monetary Role

Silver has a dual role: it is both an industrial metal and a monetary asset. Its industrial demand is strong, particularly in technology, green energy, and manufacturing. At the same time, silver has long been recognized as a store of value, historically complementing gold in times of economic uncertainty. This combination of industrial and monetary demand makes physical silver an especially compelling asset today.

Understanding the Broader Fiat Risk

Japan’s situation highlights a broader concern: the fragility of a financial system built entirely on fiat currency. Throughout history, countries that abandoned hard money standards like gold or silver often faced inflation, currency devaluation, or economic collapse. Today, every major currency is fiat, meaning its value relies solely on trust and government management.

When debt levels rise unchecked and central banks intervene heavily, that trust is tested. Rising gold and silver prices are symptomatic of this phenomenon—they indicate that investors are increasingly wary of fiat currency stability and are seeking tangible assets to preserve wealth.

How to Approach Physical Precious Metals

For investors, the key takeaway is clear: owning physical gold and silver can serve as a hedge against financial instability. While market prices may fluctuate in the short term, the long-term trend of rising debt, central bank interventions, and global uncertainty supports continued interest in tangible assets.

Strategies for investing in physical metals include:

- Diversification: Allocate a portion of your portfolio to both gold and silver to spread risk.

- Secure storage: Ensure that bullion or coins are stored safely, either in a private secure facility or a trusted vaulting service.

- Dollar-cost averaging: Gradually accumulate metals over time to reduce the impact of short-term price volatility.

Owning physical metals is not about chasing short-term gains. It is about preserving wealth, maintaining financial sovereignty, and protecting against systemic risk.

Conclusion

Japan’s rising bond yields are more than a local financial story—they are a global signal. Higher yields, combined with Japan’s extraordinary debt, highlight systemic pressures that could affect currencies, markets, and economies worldwide. Gold and silver, especially in physical form, offer a hedge against these risks, providing both security and stability in uncertain times.

Investors who recognize the connection between rising Japanese yields, global debt pressures, and precious metals may find that physical gold and silver are not just investments—they are essential tools for safeguarding wealth and maintaining financial confidence in a turbulent world.

If you’d like to learn more about physical gold or request educational resources, Allegiance Gold is always here to help.

📞 Call Allegiance Gold today at 844-790-9191

or

📅 Book your appointment online to learn how to secure your future through physical gold and silver.

Request Your 2026 Gold Forecast Report To See The Full List of Institutions And Their Gold Price Forecasts

Download Your Free 2026 Gold Forecast Report

To Start Your Gold IRA Today:

Download Your Free Gold IRA Guide | Open Your Gold IRA Account | Book Your Consultation

Protect your financial future with Allegiance Gold an Inc 5000 company– Your trusted partner in Gold and Silver IRA investments.

|

|

Buy Now |

Buy Now |

Act now and join the millions who trust gold to secure their wealth.

Gold Products

Gold Products Silver Products

Silver Products Platinum

Platinum