Unveiling the Truth About Unethical Practices in the Precious Metals Industry

The precious metals industry has long been a reliable avenue for individuals seeking to protect their wealth against market volatility and inflation. Products such as gold and silver, particularly in a Gold IRA, offer a stable store of value and have become increasingly popular in recent years. However, not all companies operating in this space prioritize ethical practices or transparency.

This blog sheds light on some common unethical practices used by certain companies to lure customers into paying higher prices for precious metals. At Allegiance Gold, we pride ourselves on maintaining ethical standards and putting the best interests of our clients first. Let’s explore the red flags you should watch for when considering an investment in a Gold IRA.

The “Free Fees” Trap: What’s Really Happening?

One of the most common tactics used by unethical companies is the promise to “cover your custodial or depository fees” if you work with them. On the surface, this might seem like a great deal. After all, custodial and depository fees are a standard part of managing a Gold IRA, and who wouldn’t want to save money?

But here’s the reality: nothing in business is truly free.

While these companies may appear generous, they often recover these “free fees” by charging exorbitant premiums on the precious metals you purchase. For instance:

- Gold or silver products are sold at significantly inflated prices.

- Premiums on coins or bars far exceed fair market value.

In the end, the client—unknowingly—pays for those “free” services several times over through the inflated cost of their investment.

Understanding Gold IRA Fees

To navigate the industry effectively, it’s essential to understand the standard fees associated with a Gold IRA:

Annual Custodial Fees:

-

-

- Account Maintenance: These are fees charged by your IRA custodian to manage your account. This includes administrative tasks such as account setup, reporting, and compliance with IRS regulations. Learn more about custodial fees here.

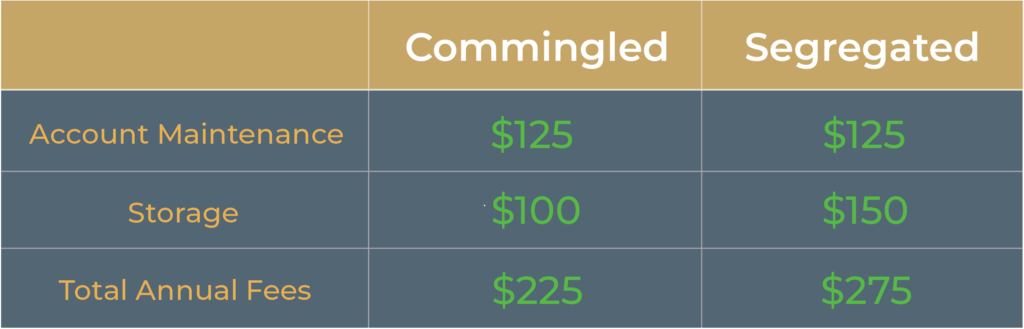

- Depository Fees: These fees cover the secure storage of your physical precious metals in an IRS-approved depository. Storage ensures your assets are inspected, audited and insured for your benefit protected from theft, damage, natural disaster or fraud. There are 2 types of storages: Commingled and segregated. Discover more about depository requirements. The standard annual fees are as follows:

-

Premiums on Precious Metals: The cost of gold and silver includes a premium over the spot price, which accounts for factors like minting, packaging, and distribution. Track current spot prices of gold and silver.

It’s important to note that custodial and depository fees across reputable companies are relatively standard. Where discrepancies arise is in the premiums charged for precious metals.

How Unethical Practices Inflate Costs

Here’s a breakdown of how some companies operate:

- Hidden Premiums: Companies promise to cover your custodial or depository fees but inflate the cost of the metals you’re purchasing. You’re essentially paying those fees—and then some—through artificially high product prices.

- Lack of Transparency: They may bundle fees into the overall cost without providing a clear breakdown of the price per unit in comparison to the price of gold, making it difficult for customers to know what they’re truly paying for.

- Lack of Ability to Monitor Values: Many precious metals dealers act as a marketing firm and do not hold any inventory. As such, many do not have live pricing on their website. This forces the client to be dependable on the dealer and not know exactly what the values are.

- Exaggerated Claims: These companies often market themselves as offering “free storage” or “no fees,” creating the illusion of savings while profiting heavily from the hidden costs.

How Allegiance Gold Stands Apart

At Allegiance Gold, our approach is simple: we prioritize transparency and integrity. Here’s how we ensure our clients’ best interests are always at the forefront:

- Fair Pricing:

- If we run promotions, such as offering free storage or free metals, we do not alter our pricing to compensate. Instead, we choose to absorb those costs, even if it diminishes our profit margin.

- Transparent Fee Structure:

- We provide a clear and detailed breakdown of all costs, including custodial fees, depository fees, and premiums on precious metals. You’ll always know what you’re paying and why. Explore our transparent pricing approach.

- Educational Approach:

- Our goal is to empower our clients with the knowledge they need to make informed decisions. Whether you’re buying gold or silver, rolling over an existing IRA into a Gold IRA, or exploring storage options, we’re here to guide you every step of the way. Visit our education center.

- Ethical Promotions:

- Any promotions we offer are designed to benefit you without compromising your investment’s value. For example, if we provide free storage for a year, it’s a genuine perk—not a hidden cost.

What You Should Know Before Investing

Before choosing a precious metals company, it’s crucial to do your due diligence. Here are some tips:

- Ask Questions:

- What is the premium on the gold or silver I’m purchasing in comparison to the spot price?

- How are custodial and depository fees handled?

- Is there a breakdown of all fees in writing?

- Compare Pricing:

- Research the current spot price of gold and silver and compare it to the prices offered by the company. Excessive markups can be a red flag.

- Understand Promotions:

- If a company offers “free fees” or “free storage,” ask how those costs are being covered. Remember, if it sounds too good to be true, it probably is.

- Verify Reputation and History:

- Look for reviews and testimonials from other customers. Check the company’s rating with organizations like the Better Business Bureau. View BBB ratings here.

- Check with the State to confirm how long the dealer has been in business.

- Do Not rely on 3rd party websites that list top 10 companies. Those are paid marketing engagement that profit mainly from the company listing them such as money.com. Instead, chose a company that is experienced, has the credentials and reputation and a solid track record.

- Determine if the representative is aligned with your goals and not being pushy.

The Value of Working with a Trusted Partner

When you choose a company like Allegiance Gold, you’re not just buying gold or silver—you’re investing in a partnership built on trust, transparency, and mutual respect. We’re committed to:

- Helping you navigate your Gold IRA with confidence.

- Ensuring your investment is protected for the long term.

- Providing ongoing support and education as your trusted partner.

Closing Thoughts

Investing in precious metals is a powerful way to safeguard your financial future, but it’s important to work with a company that prioritizes your best interests. Unethical practices, such as inflated premiums disguised as free fees, can undermine the value of your investment.

At Allegiance Gold, we’re committed to ethical practices, fair pricing, and complete transparency. Whether you’re buying gold, exploring Gold IRA options, or looking into Strata fees and storage, we’re here to provide honest guidance and support every step of the way.

If you’re ready to start your journey or have questions about your options, reach out to us today. Together, we can help you achieve lasting financial security with confidence.

Download Your Free Gold IRA Guide | Open Your Gold IRA Account

|

|

Buy Now |

Buy Now |

Act now and join the millions who trust gold to secure their wealth.

Custom Precious Metals IRA

Custom Precious Metals IRA Gold IRA

Gold IRA Gold Products

Gold Products Silver Products

Silver Products Platinum

Platinum