The Evolution of the Dollar and the Rise of De-Dollarization: Why Gold and Silver Matter More Than Ever

In recent years, concerns around the stability of the U.S. dollar and the growing trend of “de-dollarization” have prompted both governments and individual investors to reconsider their financial strategies. With global central banks increasing their gold reserves and many nations exploring alternatives to dollar-based transactions, it’s an important time to understand these changes and how they may impact your financial future.

This blog will cover key topics: the history of the dollar’s purchasing power, the concept and implications of de-dollarization, and the role of precious metals like gold and silver in navigating these uncertain times.

- The Dollar’s Journey: A Brief History of Its Purchasing Power

The U.S. dollar has evolved significantly since its introduction in 1792, gaining prominence over centuries as a stable and trusted global currency. However, its purchasing power has faced consistent erosion due to inflation and economic policy changes. Initially backed by gold and silver, the dollar held intrinsic value, offering a solid hedge against inflation.

The gold standard era ended in 1971 when the U.S. decoupled the dollar from gold under President Nixon. This shift allowed the Federal Reserve to print money without gold reserves to back it, leading to what we know as fiat currency. Since then, the dollar’s value has gradually diminished, eroding purchasing power as the money supply has expanded.

In fact, the dollar has lost over 95% of its purchasing power since its inception. For example, according to the CPI inflation calculation on the U.S. Bureau of Labor Statistics, a $1,000,000 from January 2000 has a buying power of $535,361.45 in September 2024, this equates to loss of 46%.1

This trend of decline has underscored the importance of assets that aren’t subject to government printing or manipulation—assets like gold and silver that have intrinsic value.

- What is De-Dollarization?

De-dollarization refers to the global movement of countries seeking to reduce reliance on the U.S. dollar for trade and financial transactions. This shift is driven by several factors:

- Economic Sanctions: Countries facing sanctions from the U.S. (e.g., Russia and Iran) seek alternatives to avoid financial restrictions.

- Growing Economies: Emerging economies, especially those in the BRICS coalition (Brazil, Russia, India, China, and South Africa), are looking to establish their currencies as viable alternatives. Further, In January 20204, BRICS added 4 new member countries: Iran, Ethiopia, Egypt and United Arab Emirates. The BRICS+ coalition is attracting new counties. On 24 October 2024, an additional 13 countries namely Algeria, Belarus, Bolivia, Cuba, Indonesia, Kazakhstan, Malaysia, Nigeria, Thailand, Turkey, Uganda, Uzbekistan and Vietnam were added into BRICS as partner countries, though not as full members.

- Diversification Goals: Many nations want to reduce dependency on the dollar due to the risk of dollar volatility impacting their economies.

In essence, de-dollarization is the gradual reduction of dollar dominance in global financial markets.

- What Would Be the Impact of De-Dollarization?

The effects of de-dollarization could reshape the global economy and have a profound impact on the U.S. economy. If the dollar loses its reserve currency status, several consequences could follow:

- Increased Borrowing Costs: The U.S. might face higher borrowing costs as demand for dollar-denominated debt decreases.

- Currency Devaluation: Less demand for dollars could result in currency devaluation, which would further erode purchasing power domestically.

- Rising Inflation: A weaker dollar could drive up import costs, leading to inflationary pressures on goods and services within the U.S.

- Geopolitical Shifts: De-dollarization could enhance the influence of other nations, particularly within the BRICS coalition, potentially reducing U.S. economic and geopolitical leverage.

While these are possible outcomes, the actual impact depends on the speed and extent of the de-dollarization process.

- Gold Holdings by Global Central Banks Have Increased

In response to the weakening dollar and global financial uncertainties, central banks worldwide have been increasing their gold reserves. According to the World Gold Council, central banks have been on a gold-buying spree in recent years, driven by a desire to hedge against dollar volatility and inflation.

Because gold is a tier 1 reserve asset, it competes with currencies and US Bonds. When the US places sanctions and frozen Russian assets invested in US Bonds, starting in Q3-2022, the rolling 4 quarters average central banks buying of gold increased from 365 tons to 1,310 tons.2

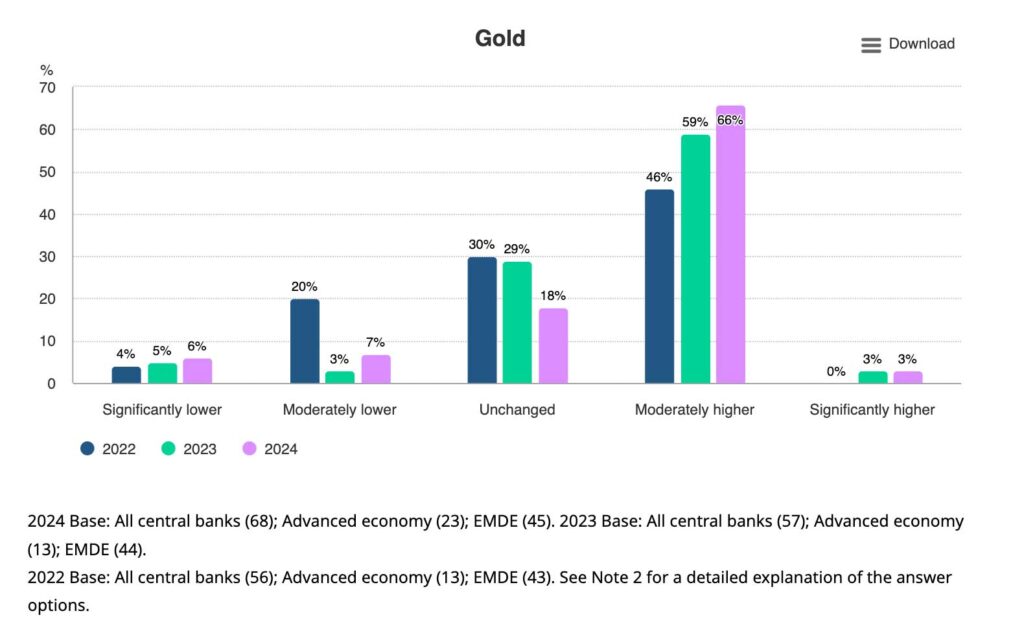

Further, Central Bank’s recent survey suggests that 66% are planning to increase their gold reserves in the next 5 years.3

Gold has long been viewed as a safe-haven asset, providing stability in times of economic turbulence. By increasing gold reserves, central banks aim to diversify their holdings and protect their economies from potential risks associated with dollar depreciation.

For individual investors, this central bank trend underscores the importance of gold as a cornerstone of a diversified portfolio.

- De-Dollarization in Payments

One significant aspect of de-dollarization is the shift in global payments. Countries are increasingly opting for bilateral trade agreements that bypass the dollar. For instance:

- China and Russia have established a system for trading directly in their respective currencies, avoiding the dollar.

- India and Iran have agreed to trade oil using the Indian rupee, reducing dependency on the dollar in energy transactions.

These arrangements allow nations to conduct trade without relying on the dollar, reducing their exposure to dollar fluctuations and U.S. economic policies. As more countries adopt similar approaches, the dollar’s dominance in global trade could wane.

- De-Dollarization in Global Market Paper Assets

De-dollarization is also impacting dollar-denominated financial instruments. For example, many global investors and institutions are exploring options outside of U.S. Treasury bonds and dollar-denominated assets, instead focusing on alternatives such as:

- Gold and other precious metals as safer stores of value.

- Government bonds in other stable currencies (e.g., the Euro or the Japanese yen).

- Investments in emerging markets, which often yield better returns than U.S.-based assets, especially as they expand outside the dollar sphere.

A shift away from dollar-based assets may increase volatility in the U.S. financial markets, impacting average investors, retirement accounts, and long-term savings reliant on dollar stability.

- Is De-Dollarization Imminent?

While de-dollarization is a growing trend, it’s unlikely to happen overnight. The dollar’s dominance is deeply rooted in the global financial system, and it will take time for alternative systems to gain traction. However, the increasing shift towards de-dollarization signals that the dollar’s hold on the global market is not as strong as it once was. The IMF reported the gradual decline in the US dollar shares of FX reserves representing about 72% in 2000 to about 58% in June of 2024.4

As the pace of de-dollarization continues to grow, it’s crucial for investors to remain aware of the potential impacts on their wealth, especially for dollar-based investments and retirement portfolios.

For the middle class, the effects of a weaker dollar can be felt more directly and immediately than for large corporations or government entities, which often have diversified assets and greater financial flexibility. For everyday individuals with limited savings, the erosion of the dollar’s purchasing power has a direct impact on their livelihood, affecting the costs of essentials like food, housing, and healthcare. Unlike large entities, the average American may have fewer tools and opportunities to shield against these economic shifts, making de-dollarization and dollar volatility a significant concern for their financial stability.

- Why Diversifying with Gold and Silver Lowers the Impact from De-Dollarization

While all investments are intended to deliver returns, true portfolio success relies on a balanced approach. Gold and silver, although often underrated due to their lack of dividends or cash flow, are foundational to a well-rounded portfolio for unique reasons. Historically, these assets have proven essential because of their rarity, limited production, intrinsic value, appreciation potential, global recognition, and the absence of third-party counterparty risks. To believe a portfolio is fully diversified without the inclusion of these critical assets is to overlook the most significant element of effective diversification.

Gold and silver have historically served as hedges against currency devaluation and inflation, making them especially valuable during times of economic transition or uncertainty. Here’s why adding these precious metals to your portfolio can help mitigate the risks associated with de-dollarization:

- Intrinsic Value:Unlike paper assets, gold and silver hold intrinsic value that is not tied to any single currency, making them resilient to shifts in currency dynamics.

- Safe-Haven Asset:During financial instability, precious metals often retain or increase in value as investors seek reliable, stable assets.

- Protection Against Inflation:As the dollar’s purchasing power declines, gold and silver have historically appreciated, preserving wealth where traditional investments may fall short.

- Global Demand:Demand for gold and silver is worldwide, and each have a broad based demand from industrial usages, central banks, investors, jewelry and various other applications, allowing these assets to perform well regardless of the U.S. dollar’s strength or status.

For investors, including gold and silver in a balanced portfolio provides a practical safeguard against economic fluctuations. As the dollar’s influence continues to shift, these metals serve as a steadying force, helping to protect wealth from the potential effects of de-dollarization.

Conclusion

The global financial landscape is evolving, and de-dollarization is emerging as a significant trend. While the dollar remains a powerful currency, the actions of central banks and global markets indicate a shifting sentiment. For those concerned about potential risks to their wealth, diversifying with precious metals like gold and silver offers a time-tested approach to preserving value.

In an uncertain world, gold and silver can provide the peace of mind and financial resilience needed to face economic changes head-on. Start exploring how these assets can protect your wealth by visiting Allegiance Gold E-Commerce Precious Metals Collection.

Sources:

- https://www.bls.gov/data/inflation_calculator.htm

- https://www.gold.org/goldhub/research/gold-demand-trends/gold-demand-trends-q3-2024/central-banks#from-login=1

- https://www.gold.org/goldhub/research/2024-central-bank-gold-reserves-survey

- https://www.imf.org/en/Blogs/Articles/2024/06/11/dollar-dominance-in-the-international-reserve-system-an-update

Start Your Gold and Silver Collection online from Allegiance Gold

If you’re ready to take advantage of gold’s unique benefits, buy gold online today from our store. With a simple, secure process and expert customer service, we make it easy for you to add this valuable asset to your portfolio. Whether you’re new to investing or a seasoned pro, the best time to invest in gold is now. Don’t miss the opportunity to secure your financial future with this timeless, valuable asset.

Take the first step today—buy gold online now and be prepared for whatever the future holds. Shop our exclusive Gold Birds of Prey Signature Collection online.

Click here to buy your precious metals at the lowest cost in the industry and safeguard your assets with a timeless investment.

| Exclusive 2022 Gold White Bellied Coin | Exclusive 2022 Gold Osprey Coin |

|

|

Buy Now |

Buy Now |

Act now and join the millions who trust gold to secure their wealth.

Custom Precious Metals IRA

Custom Precious Metals IRA Gold IRA

Gold IRA Gold Products

Gold Products Silver Products

Silver Products Platinum

Platinum