Why Central Banks are Increasing Gold Reserves and Why You Should Too

Gold has always been a symbol of wealth, security, and stability. Its allure transcends cultures and centuries, making it a perennial investment choice. Recently, this timeless asset has captured even more attention. In the second quarter of this year, gold demand surged, driven by strong investment from over-the-counter (OTC) markets and decisive actions from central banks worldwide.

This renewed interest highlights a crucial point for individual investors: if central banks are stocking up on gold, perhaps you should too.

Understanding Why Central Banks are Increasing Gold Reserves

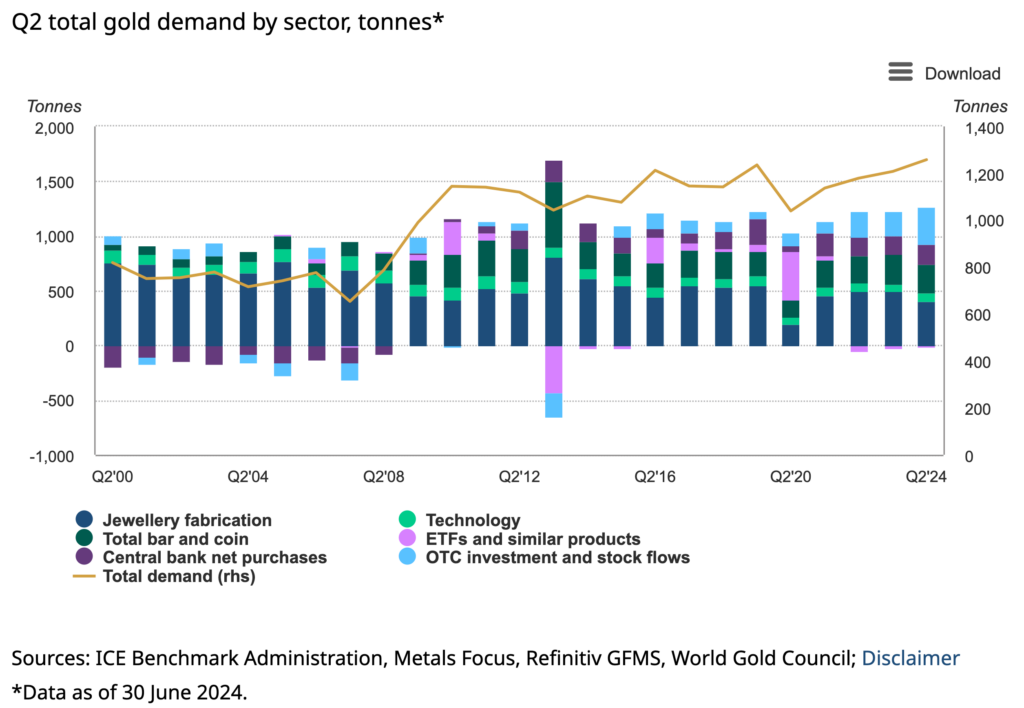

In Q2, excluding OTC investments, gold demand fell by 6% year-over-year (y/y) to 929 tonnes. This decline was primarily due to a sharp drop in jewelry consumption, which overshadowed modest gains in other sectors. However, when OTC investments are included, total gold demand rose by 4% y/y to 1,258 tonnes, marking the highest second quarter in our data series dating back to 2000.

Despite the decline in jewelry consumption, which dropped 19% y/y to a four-year low of 391 tonnes, other areas showed resilience. Central banks increased their net gold purchases by 6% y/y to 184 tonnes, motivated by the need for portfolio protection and diversification.

Global gold ETF holdings saw a minor decline of 7 tonnes in Q2, a significant improvement compared to the 21-tonne drop in Q2 2023. Early outflows were followed by budding inflows later in the quarter. Retail bar and coin investment fell by 5% to 261 tonnes, mainly due to weaker demand in Western markets.

Conversely, gold used in technology jumped 11% y/y, fueled by the ongoing AI trend driving demand in the tech sector.

The Impact of Record Gold Prices

The Impact of Record Gold Prices

The London Bullion Market Association (LBMA) reported that the gold price averaged a record $2,338 per ounce in Q2, an 18% increase y/y and a 13% rise quarter-over-quarter (q/q). In May, gold reached a new high of $2,427 per ounce. This record price environment significantly impacted jewelry consumption but also reflected strong investment demand, particularly from OTC markets and central banks.

OTC investment amounted to 329 tonnes, a significant portion of the total gold demand in Q2. This, combined with ongoing central bank purchases, drove the price to a series of record highs during the quarter. Total gold supply grew by 4% y/y to 1,258 tonnes, with mine production reaching a record 929 tonnes for a second quarter. Recycling supply was the highest for a second quarter since 2012, responding to the rising gold prices.

Regional investment trends continued to diverge, with robust demand for bars, coins, and ETFs in the East contrasting with a marked decline in the West. However, Western ETF investment flows have started to return in Q3, suggesting a potential shift in trends.

Historical Context: Gold’s Enduring Appeal

Gold has been a valuable asset for thousands of years. Its unique properties, such as its malleability, conductivity, and resistance to tarnish, have made it a prized material for jewelry, currency, and industrial applications. Historically, gold has been used as a store of value and a hedge against inflation, economic instability, and geopolitical risks.

During times of crisis, gold often shines as a safe haven asset. For instance, during the 2008 financial crisis, gold prices surged as investors sought refuge from collapsing stock markets and failing banks. Similarly, during periods of high inflation, gold tends to perform well as it retains its value better than fiat currencies.

In recent years, central banks around the world have been increasing their gold reserves. This trend is driven by several factors, including the desire to diversify away from the US dollar, hedge against economic uncertainties, and strengthen financial stability.

Why Central Banks are Buying More Gold

- Diversification: Central banks aim to diversify their reserves to reduce reliance on any single asset or currency. Gold, being a tangible asset with intrinsic value, provides an excellent diversification tool.

- Inflation Hedge: With inflation rates rising globally, central banks are turning to gold as a hedge. Gold has historically maintained its value in inflationary environments, making it a reliable asset during such times.

- Geopolitical Stability: In times of geopolitical tension or economic uncertainty, gold is seen as a safe haven. Central banks purchase gold to protect their reserves from potential crises.

- Monetary Policy: Central banks may also buy gold to support their monetary policy objectives. For instance, during periods of low interest rates, gold can offer a better return compared to other low-yielding assets.

The Case for Individual Investors

If central banks, with their vast resources and sophisticated financial models, are increasing their gold holdings, it sends a strong signal to individual investors. Here are a few reasons why you should consider adding gold to your investment portfolio:

- Wealth Preservation: Gold is an effective way to preserve wealth over the long term. Unlike fiat currencies, which can be devalued by inflation or government policies, gold retains its value.

- Diversification: Adding gold to your portfolio can enhance diversification. Gold often moves inversely to other assets like stocks and bonds, providing a hedge against market volatility.

- Inflation Protection: With inflation on the rise, gold can serve as a hedge. Historically, gold prices have increased during periods of high inflation, protecting your purchasing power.

- Crisis Hedge: Gold is a safe haven asset that tends to perform well during economic or geopolitical crises. Having gold in your portfolio can provide a safety net in uncertain times.

Historical Data Supporting Gold Investment

Historically, gold has demonstrated its value as an investment. Let’s look at some key data points:

- 1970s Inflation: During the 1970s, when inflation rates were high, gold prices soared from around $35 per ounce in 1971 to over $800 per ounce by 1980. This dramatic increase showcased gold’s ability to protect against inflation.

- 2008 Financial Crisis: In the wake of the 2008 financial crisis, gold prices rose from around $800 per ounce in 2008 to over $1,900 per ounce by 2011. Investors flocked to gold as a safe haven amid economic turmoil.

- COVID-19 Pandemic: During the COVID-19 pandemic, gold prices reached new highs, peaking at over $2,000 per ounce in August 2020. The pandemic-induced economic uncertainty and massive monetary stimulus drove investors to seek the stability of gold.

Future Outlook for Gold

Looking ahead, several factors suggest that gold will continue to be a valuable asset:

- Global Economic Uncertainty: Ongoing geopolitical tensions, trade wars, and economic uncertainties will likely drive demand for gold as a safe haven asset.

- Inflation Pressures: With inflationary pressures building in many economies, gold’s role as an inflation hedge will become increasingly important.

- Central Bank Buying: The continued trend of central bank gold purchases will support gold prices and signal its importance as a reserve asset.

- Technological Demand: The growing demand for gold in technology, particularly in the AI and electronics sectors, will add another layer of support for gold prices.

Conclusion

The current gold market dynamics, characterized by record prices and strong demand from central banks, highlight the enduring appeal of this precious metal. For individual investors, the actions of central banks offer a compelling reason to consider gold as part of their investment strategy. By investing in gold, you can preserve your wealth, diversify your portfolio, protect against inflation, and hedge against economic and geopolitical uncertainties.

As the saying goes, “Follow the money.” If central banks are buying more gold, it might be wise for you to do the same. Gold has stood the test of time as a valuable asset, and its future looks just as promising.

Gold Products

Gold Products Silver Products

Silver Products Platinum

Platinum