Feds announce .25% Interest Rate hike to help cripple the economy more…

The Clowns keep the circus in town while the Ringmaster stays silent.

Congress has tasked the Federal Reserve with the job of keeping the U.S. economy running as smoothly as possible.1

This is a joke that keeps getting told but it has lost its gag reel. Jerome Powell said that “inflation is transitory” last year, and abruptly had a poor response on his comments after it was shown that the Chair of the Federal Reserve doesn’t truly understand basic economics.

Jerome Powell is the person in charge of our country’s financial stability, yet in interview after interview, he seems more like an emo-economist. He just doesn’t care or doesn’t know how to deal with the current financial crisis.

The Federal Reserve announced a .25% interest rate hike today that will again hit American’s pockets and could lead to a massive market sell-off and the most devasting recession in history.

The propaganda machine is in full swing as gas prices and inflation hit record levels and Biden tells us that we are doing our part against Russia as our heating and gas bill soar. Inflation will hit record highs again in March as the soaring gas prices are priced in.

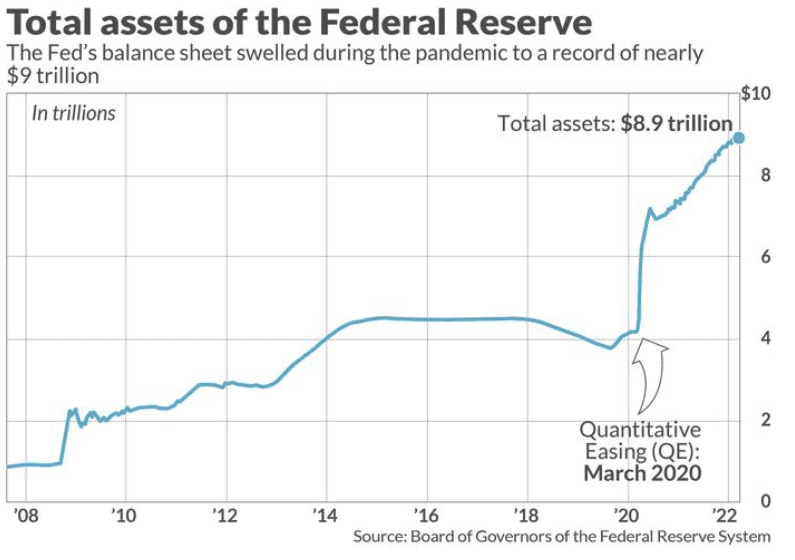

Assets of the Federal Reserve

Biden says he understands our pain while he digs the knife of spiraling inflation and multiple interest rate hikes into the belly of Americans.

Higher interest rates will stifle the economy, making it more expensive for small businesses to borrow money, creating a squeeze on homeowner’s mortgage payments, and yet again taking more of your savings.

Bond yields are higher as more Americans realize that the value of the dollar has is set to go in line with the Russian ruble. The devaluation of the dollar is not a myth anymore, it is a fact. We are paying more for everything, 40% more in some cases over just 1 year ago.

There is still time to save your retirement before it goes in the Fed’s pockets to prop up the tent of this circus.

Gold has stability. It is an asset class that most savvy investors turn to in uncertain times. It is also a safe haven as it holds many Tax benefits for those who take advantage of the IRS loopholes.

Let’s face it, these are uncertain times…

It is time to take action before this Administration starts limiting your ability to withdraw cash at the banks or take more of your savings.

Adding Gold to Your Portfolio

There are a number of ways to add gold to your portfolio. The best way to find out all the different options for you to invest in gold is to call the executives at Allegiance Gold at 844-790-9191. Our executives stay up to date with world news and how it impacts a financial portfolio. When you speak to our executives, make sure to inquire about our FREE Gold IRA Guide. This guide will not only explain why gold is important for your financial portfolio but will also discuss some of the worldly events that directly affect the price of gold. Call or fill out the form below and receive your guide today!

Request our FREE investment guide to uncover insider tips and strategies for protecting your wealth.

Gold Products

Gold Products Silver Products

Silver Products Platinum

Platinum