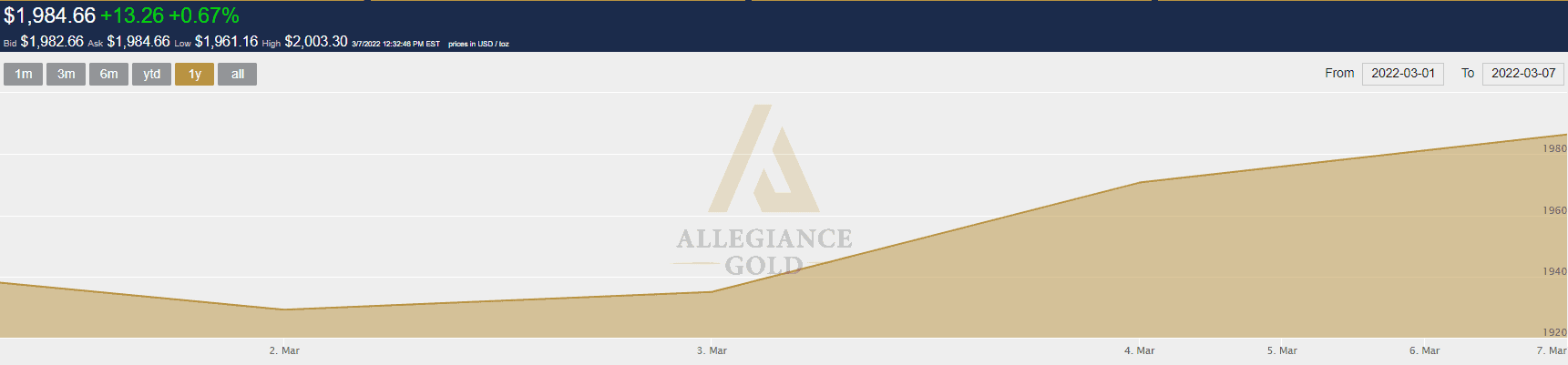

GOLD IS BACK ABOVE $2,000 PER OUNCE

Over this past weekend, gold made a comeback and reached over the $2,000 per ounce mark. This was the first time since the year 2020 that gold had reached this price point. With all the political turmoil, inflation, and high-interest rates on the brink of being implemented, it is driving the price of gold to where investors want it. The major driving force has been the turmoil between Russia and Ukraine. Russia has become one of the largest producers of gold within the last five years; and with all the sanctions that have been implemented, gold is becoming scarce. The first time that gold had reached $2,000 price per ounce was in 2020, as the global pandemic had the ultimate impact on the economy and on gold to significantly go up in price.

The time to act on gold is now! With many analysts and experts claiming and predicting that gold will be making a steep ascension in the near future, the opportune moment to invest may be slimming down soon. Investors, who already have invested in gold, have seen what it can do to their financial portfolio. Also, since inflation rates have been higher than before, gold has been known for performing best in times of high inflation. The combination of inflation, war, and scarcity will allow gold to continue to grow and climb rapidly. Acquiring gold is simple as well! The executives at Allegiance Gold make it simple for you to learn and understand the benefits of adding gold to any financial portfolio. Don’t wait until the next time that gold rises to invest. Take advantage now and allocate gold to your portfolio today! Call 844-790-9191 or visit www.AllegianceGold.com. Make sure to ask about receiving our FREE Gold IRA Guide!

Request our FREE investment guide to uncover insider tips and strategies for protecting your wealth.

Custom Precious Metals IRA

Custom Precious Metals IRA