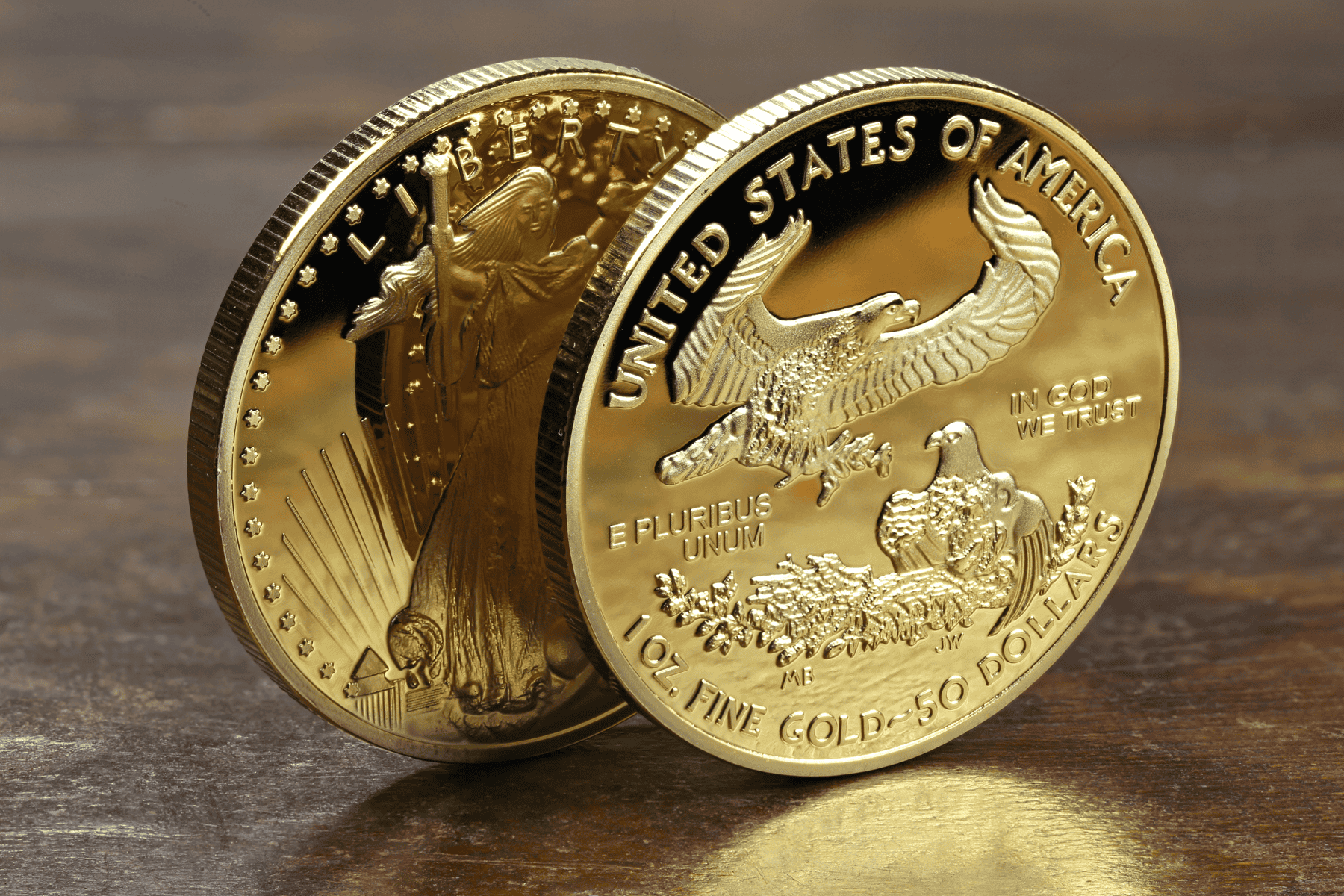

Gold has recently surged past the $2,500 mark, breaking records and signaling significant economic shifts.

This milestone reflects increasing economic uncertainty, persistent inflation, and global geopolitical tensions. The weakening of fiat currencies and market volatility have driven investors toward gold as a safe haven.

The big question is whether gold has more fuel left in the tank to drive it even higher?

In our opinion, we believe the answer to that could be yes for various reasons, most of which are unlikely to go away anytime soon.

The top 10 reasons the price of gold will increase in 2024

- Continued Economic Uncertainty: Central banks are struggling to manage inflation and interest rates, which could push gold prices even higher.

- Demand from Emerging Markets: Countries like China and India are increasing their gold reserves, driving up demand and prices.

- Inflation Hedge: With inflation expected to remain high, gold will continue to be a preferred asset for preserving wealth.

- Investment Diversification: As traditional assets falter, more investors are turning to gold, sustaining its price growth.

- Geopolitical Risks: Tensions related to Russia/Ukraine, the Middle East, and uncertainty surrounding the upcoming U.S. presidential election are contributing to gold’s rise.

- Strong Retail Demand in China: Economic struggles and property woes in China are leading to strong demand for gold, seen as a stable investment.

- Central Bank Demand: Amid geopolitical uncertainty and de-dollarization, central banks are continuing to buy gold, boosting its value.

- US Presidential Election: The outcome could lead to increased government spending, lifting U.S. debt levels and further supporting gold prices.

- Rising Debt-to-GDP Ratios: Growing debt concerns, particularly in the U.S., are driving rich individuals and family offices to invest in gold.

- Incoming U.S. Rate-Cutting Cycle: Historically, periods of U.S. rate cuts have seen strong performances from gold.

Conclusion

Gold’s rise above $2,500 is a significant milestone, but the future looks even brighter. With ongoing economic challenges, diversifying your portfolio with gold is a smart move to hedge against uncertainty and preserve wealth. As central banks and investors continue to seek stability, gold’s appeal as a reliable and tangible asset is only set to increase.

Click here to buy your precious metals at the lowest cost in the industry and safeguard your assets with a timeless investment.

|

|

Buy Now |

Buy Now |

Act now and join the millions who trust gold to secure their wealth.

Gold Products

Gold Products Silver Products

Silver Products Platinum

Platinum