How Top Investors Turn Gold and Silver Into Wealth Creators

Gold and silver have long been considered safe havens during economic uncertainty. But for savvy investors, these precious metals are more than just a hedge against inflation or a safeguard against market volatility—they are wealth creators. Top investors have unlocked the potential of gold and silver to not only preserve wealth but also grow it strategically.

Here are the top ways we’ll explore how gold and silver can be used as wealth creators, focusing on the strategies employed by top investors. From diversification to leveraging market cycles, we’ll uncover the secrets to turning these precious metals into valuable assets within your portfolio.

-

Understanding the True Value of Gold and Silver

Gold and silver are not just shiny metals; they are timeless assets with intrinsic value. Unlike paper currency, which can be printed at will, gold and silver are finite resources. This scarcity is the foundation of their value, providing stability even when other investments falter.

Gold and Silver Are Globally Recognized

These metals are universally accepted and valued across all economies, making them a truly global asset. Whether you’re in the United States, Europe, or Asia, gold and silver hold their worth, offering liquidity and reliability.

Historical Performance

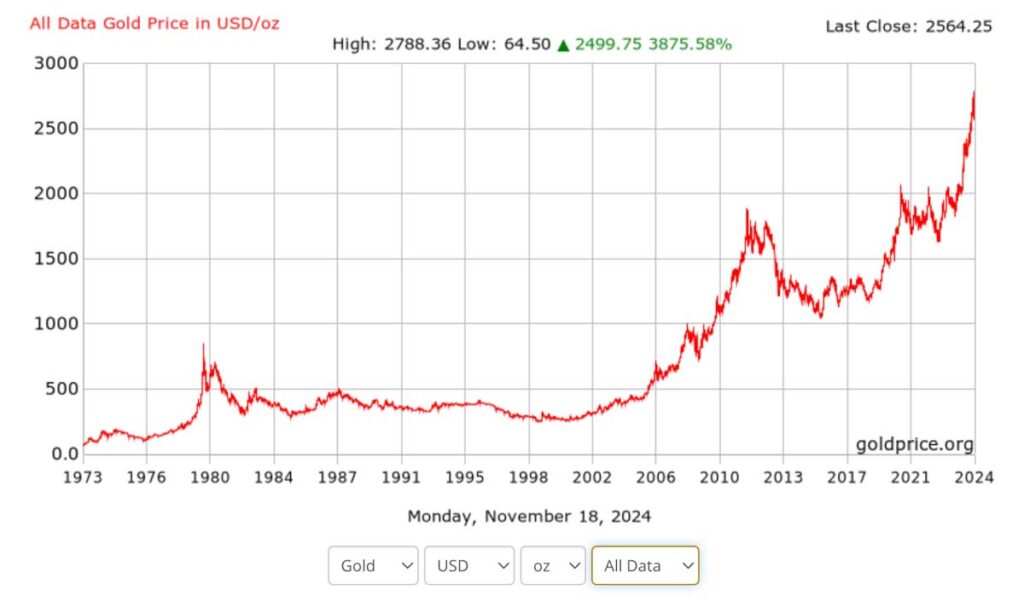

Over the past century, gold and silver have consistently outperformed many traditional investments during periods of economic instability. For example, gold prices rose by over 600% during the stagflation of the 1970s. Similarly, silver saw a 400% increase during the same period, demonstrating their ability to thrive in turbulent times.

-

Diversification: The Cornerstone of Wealth Creation

Diversification: The Cornerstone of Wealth Creation

Top investors understand that no single asset class can provide complete financial security. Diversification is essential, and gold and silver play a crucial role in balancing risk and reward.

A Hedge Against Inflation

Inflation erodes the purchasing power of paper currency, but gold and silver often rise in value during inflationary periods. This makes them an effective hedge, protecting your portfolio from the hidden tax of inflation.

Low Correlation With Other Assets

Gold and silver have a low correlation with stocks and bonds, meaning they often perform well when traditional markets falter. By adding these metals to their portfolios, top investors reduce overall volatility and create a more resilient financial foundation.

Portfolio Balance

Gold and silver provide a counterweight to high-risk investments. While stocks and cryptocurrencies may offer higher returns, they are also subject to significant market swings. Precious metals, on the other hand, provide stability, ensuring that a portion of your portfolio remains secure regardless of market conditions.

-

Timing the Market: Leveraging Gold and Silver Cycles

Successful investors know that timing is critical. Gold and silver prices move in cycles, often influenced by economic conditions, geopolitical events, and monetary policy.

Recognizing Market Trends

Gold and silver tend to perform well during periods of economic uncertainty, rising inflation, or weakening currency values. For example, during the 2008 financial crisis, gold prices surged by 25%, while silver saw a 15% increase. Recognizing these patterns allows investors to buy low and sell high, maximizing returns.

Buying During Lows

Top investors take advantage of market dips to accumulate gold and silver at lower prices. By adopting a long-term perspective, they position themselves to benefit from future price increases.

Selling During Highs

When gold and silver prices peak, savvy investors know it’s time to realize their gains. This strategic approach ensures they capitalize on market cycles rather than reacting impulsively to short-term fluctuations.

-

Using Gold and Silver as Leverage in Financial Planning

Precious metals are more than just investments; they are tools for strategic financial planning.

Wealth Preservation

In times of economic uncertainty, preserving wealth is just as important as growing it. Gold and silver provide a safe harbor, ensuring that your assets retain their value even when other investments decline.

Legacy Planning

For many top investors, gold and silver are part of a long-term legacy. These tangible assets can be passed down to future generations, offering a timeless store of value that is not subject to market whims.

Flexibility and Liquidity

Gold and silver are highly liquid assets. Whether you need to sell a portion to cover unexpected expenses or capitalize on an investment opportunity, these metals offer flexibility without compromising your financial security.

-

Gold and Silver in the Modern Economy

The relevance of gold and silver has only grown in today’s complex economic landscape.

Geopolitical Uncertainty

With rising tensions between global superpowers, trade wars, and shifting alliances, gold and silver serve as safe-haven assets that investors can rely on when uncertainty looms.

De-Dollarization Trends

As nations like China and Russia seek to reduce their reliance on the U.S. dollar, demand for gold and silver continues to rise. Central banks worldwide have been increasing their gold reserves, further driving up prices and solidifying their value.

Technological Advancements

Silver, in particular, plays a critical role in emerging technologies such as solar energy and electric vehicles. This industrial demand adds another layer of value, making silver a unique investment opportunity with both monetary and industrial appeal.

-

Maximizing Returns With Premium Bullion Products

While mass-produced bullion like gold bars and American Eagles are popular, top investors often look to premium bullion products for added value.

Limited Mintage and Collectibility

Premium bullion coins, such as the Australian Wildlife Series or Canadian Maple Leaf, are produced in limited quantities, adding a collectible factor to their value.

Higher Appreciation Potential

Because of their rarity and unique designs, premium bullion products often appreciate faster than standard bullion. For example, certain limited-edition silver coins have seen their value double within a few years.

Portfolio Diversification

By including both mass-produced and premium bullion in their portfolios, investors create a diverse range of assets that cater to different market dynamics and appreciation timelines.

-

Strategies for Success: Lessons From Top Investors

Start Small, Think Big

Many top investors began their precious metals journey with small, consistent purchases. Over time, these incremental investments grew into significant holdings.

Stay Educated

Knowledge is power. Successful investors stay informed about market trends, geopolitical events, and economic indicators that impact gold and silver prices.

Partner With Trusted Experts

Navigating the precious metals market can be complex. Partnering with reputable companies like Allegiance Gold ensures you have access to expert guidance, high-quality products, and transparent pricing.

-

Gold and Silver: A Strategic Component of Retirement Accounts

Top investors understand the importance of securing their financial future, and many incorporate gold and silver into their retirement accounts as a way to diversify and protect their long-term wealth. Precious metals offer a unique advantage when included in Self-Directed Individual Retirement Accounts (SDIRAs), making them a strategic choice for anyone planning for retirement.

How Gold and Silver Fit Into Retirement Accounts

A Self-Directed IRA allows investors to hold physical gold and silver as part of their retirement savings. Unlike traditional IRAs, which are typically limited to stocks, bonds, and mutual funds, SDIRAs provide the flexibility to include tangible assets like precious metals. These metals are stored in IRS-approved depositories, ensuring security and compliance with government regulations.

Tax Advantages of a Precious Metals IRA

One of the biggest benefits of including gold and silver in a retirement account is the tax advantage. When you roll over or transfer funds from a traditional IRA or 401(k) into a precious metals IRA, there are no immediate tax implications or penalties. The metals grow tax-deferred, and in the case of Roth IRAs, they grow completely tax-free.

Additionally, when it’s time to take your Required Minimum Distributions (RMDs), you can choose to receive your distribution as physical gold or silver instead of cash. This flexibility allows you to retain the intrinsic value of your investment, and since taxes are calculated on the spot (melt) value, you may also benefit from a lower taxable amount compared to fair market value.

Protection From Market Volatility

For retirement savers, the goal is to ensure stability and minimize risk. Gold and silver serve as a hedge against market volatility, offering a counterbalance to traditional paper assets. When the stock market fluctuates or the economy faces instability, these metals provide a steady foundation, helping to safeguard the overall value of your retirement portfolio.

Building a Resilient Portfolio

Top investors diversify their retirement accounts by balancing risk and reward. Gold and silver add a layer of resilience to portfolios by reducing reliance on any single asset class. This diversification protects long-term savings from inflation, currency devaluation, and other economic challenges that can erode the value of traditional investments.

Including gold and silver in your retirement account is a proactive step toward protecting your hard-earned wealth. As the global economy continues to shift, having these tangible assets as part of your retirement strategy ensures you’re prepared for the future, no matter what it holds.

-

Is Now the Right Time to Invest?

With rising national debt, ongoing inflation, and uncertainty in global markets, the need for financial security has never been greater. These uncertainties have created a perfect storm for precious metals. As we move forward, the demand for gold and silver is only expected to grow, making now an ideal time to secure your position.

Conclusion: Turning Gold and Silver Into Wealth Creators

Gold and silver are not just assets; they are opportunities. By understanding their value, leveraging market cycles, and incorporating them into a diversified portfolio, you can turn these precious metals into powerful wealth creators.

At Allegiance Gold, we are committed to helping you achieve your financial goals. Whether you’re a seasoned investor or just starting, our team provides the resources and education you need to succeed.

Ready to take the next step? Contact us today to explore how gold and silver can transform your financial future. With Allegiance Gold by your side, you’re not just investing—you’re building lasting wealth.

Start Your Gold and Silver Collection online from Allegiance Gold

If you’re ready to take advantage of gold’s unique benefits, buy gold online today from our store. With a simple, secure process and expert customer service, we make it easy for you to add this valuable asset to your portfolio. Whether you’re new to investing or a seasoned pro, the best time to invest in gold is now. Don’t miss the opportunity to secure your financial future with this timeless, valuable asset.

Take the first step today—buy gold online now and be prepared for whatever the future holds. Shop our exclusive Gold Birds of Prey Signature Collection online.

Click here to buy your precious metals at the lowest cost in the industry and safeguard your assets with a timeless investment.

| Exclusive 2022 Gold White Bellied Coin | Exclusive 2022 Gold Osprey Coin |

|

|

Buy Now |

Buy Now |

Act now and join the millions who trust gold to secure their wealth.

Custom Precious Metals IRA

Custom Precious Metals IRA Gold IRA

Gold IRA Gold Products

Gold Products Silver Products

Silver Products Platinum

Platinum