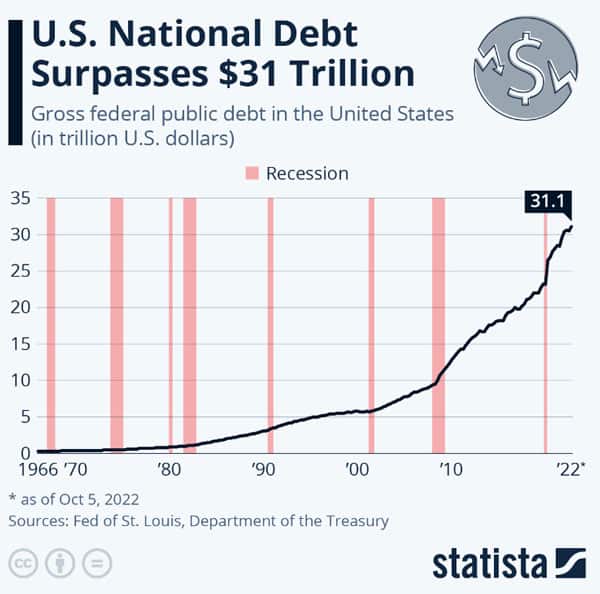

U.S. National Debt Tops $31 Trillion for the First Time

America’s borrowing binge has long been viewed as sustainable because of historically low-interest rates. Now, with interest rate hikes the nation is being placed in a fiscal downturn.

If you find that hard to wrap your head around, it basically boils down to more than $93,000 of debt for every person in the country, according to the Peter G. Peterson Foundation.

The breach of the threshold, which was revealed in a Treasury Department report, comes at an inopportune moment, as historically low-interest rates are being replaced with higher borrowing costs as the Federal Reserve tries to combat rapid inflation.

National Debt $31 Trillion for the first time

Warning sign

Federal debt is not like a 30-year mortgage that is paid off at a fixed interest rate. The government is constantly issuing new debt, which effectively means its borrowing costs rise and fall along with interest rates.

Ultimately, rising interest rates will only exacerbate the national debt, making it harder for the government to respond to a slowing economy.

“For too long, policymakers have assumed perpetually low-interest rates, and we are now seeing in real time how dangerous that assumption is,” said Michael A. Peterson, CEO of the Peter G. Peterson Foundation in a statement.

“As our debt crosses $31 trillion, it’s past time for action.”

We are living in a strange time…. A portfolio diversified with physical gold and silver is favorable during such economic uncertainties. No one can deny that physical gold is a must-have as part of your retirement account, in order to diversify it against all odds.

Request our FREE investment guide to uncover insider tips and strategies for protecting your wealth.

Gold Products

Gold Products Silver Products

Silver Products Platinum

Platinum