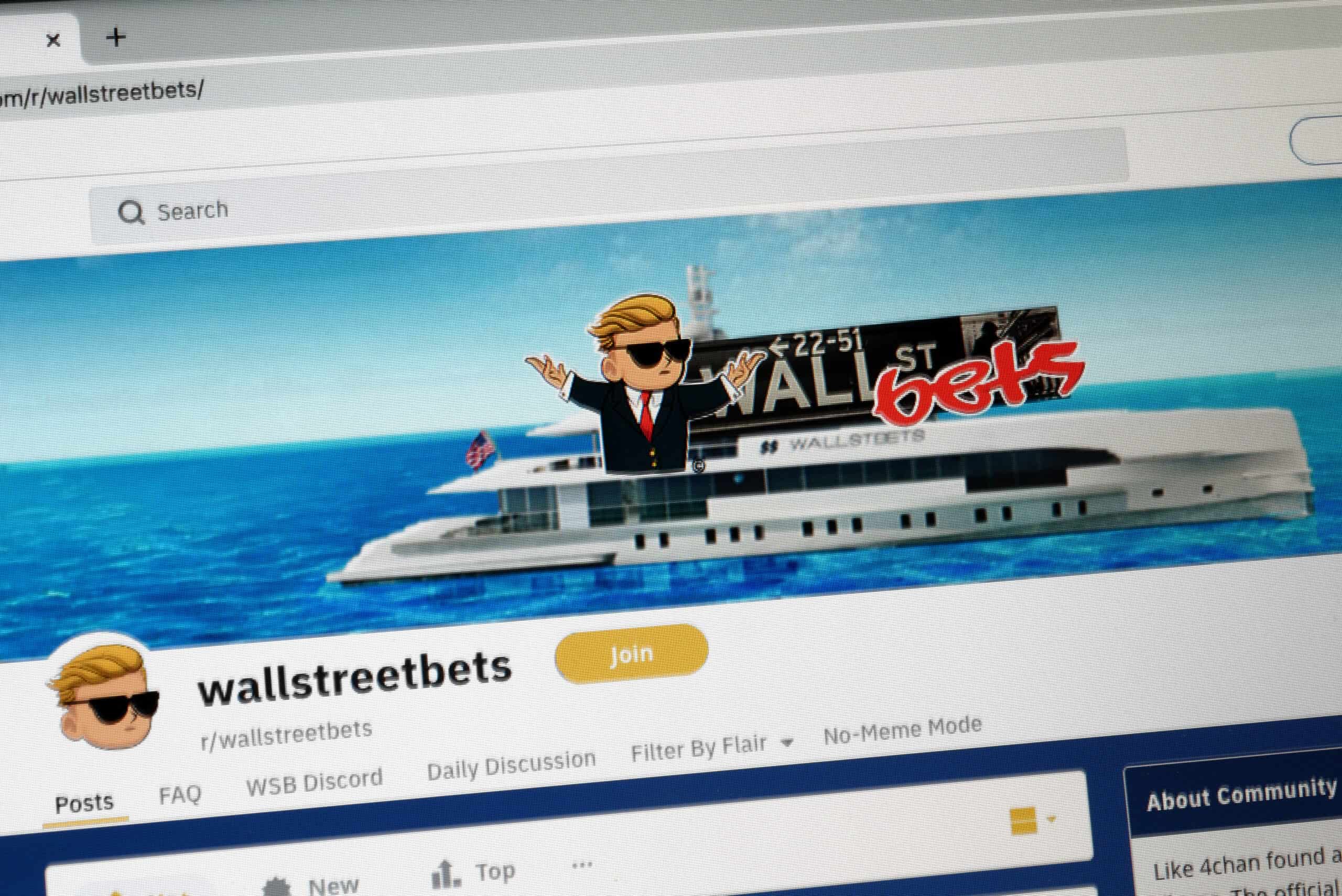

Last week, retail investors from Reddit made headlines when they targeted dying stocks as an attack on Wall Street short-sellers. Some of the most notable stocks included GME, BB, NOK, AMC, and even a joke cryptocurrency called DOGE coin. Retail investors were able to increase GME stock value by over 5000% in a few days, costing the hedge funds Citron and Melvin Capital billions of dollars. Now they’re targeting precious metals.

One thread on wallstreetbets was titled, “The Silver Squeeze is a hedge-fund coordinated attack so they can keep fighting the $GME fight.”

#silversqueeze is trending on Twitter while silver futures surged as much as 13%, a five-month high, Monday morning. Shares of precious metals miner Coeur Mining rallied 20% in premarket trading, Pan Am Silver (PAAS) also rose 15%. This all comes after retail sites warned customers they couldn’t meet the growing demand for silver coins and bullions. Our blog on the futures of silver demand considering President Biden’s green initiatives and policies had predicted demand and in turn, value to skyrocket over the next few years. Retail investors from Reddit most likely saw this trend and strategically organized to squeeze silver while it was still affordable.

Ryan Fitzmaurice, a commodities strategist at Rabobank, told CNN Business in an email, “It’s not surprising to see the sharp and abrupt uptick in consumer demand overwhelm the physical supply of silver coins held by dealers in the short term.”

The primary motive of people on wallstreetbets in their squeeze of the iShares Silver Trust ETF (SLV) may be to hurt large banks that have been known to artificially suppress prices. The most recent occurrence of this was by JP Morgan, who manipulated silver prices in order to hoard much of the supply, seeing its growing demand in the future, while creating the perception that it was metal with not much return to scare off retail investors. They were taken to court for a federal crime and forced to pay almost a million dollars in fines, however, this is not their first time and likely not their last.

Unlike Game Stop, stock values that were deemed almost worthless, silver futures have been bullish and strong as of late, trading near multi-year highs. Redditors and other retail investors are now discussing targeting the gold market next. One of the Winklevoss twins, early backers of bitcoin that sued Mark Zuckerberg, tweeted, “If the silver market is proven to be fraudulent, you better believe the gold market will be next.” Soon enough we may be seeing more activity in gold futures and other precious metals as well.

The best way to invest in precious metals is by buying physical coins or bullions. Unlike futures or ETFs that are essentially another form of paper money, having physical assets to offset market risk, especially in one as volatile now, is important for portfolio diversification. Retirees can also invest through a precious metal self-directed IRA, which can be done by rolling over an existing retirement account or by opening a new one. Silver has long been a great asset to invest in due to its high-profit margin. Much more affordable than other precious metals (for now), yet its value increases exponentially year by year. Allegiance Gold boasts some of the most competitive prices along with an extensive selection of silver products to meet your needs. Diversifying is the number one rule in investing and precious metals have been used as a form of insurance for savvy investors in a volatile market. However, it is important to diversify within precious metals as well. Three metals approved for a self-directed IRA include gold, silver, platinum, and palladium. To speak to an experienced Allegiance Gold representative to discuss how precious metals can be incorporated into your investment portfolio call 844-790-9191 today. Allegiance Gold offers direct purchase of physical precious metals as well as precious metals IRA’s.

Gold Products

Gold Products Silver Products

Silver Products Platinum

Platinum