Stagflation May Make A Comeback

Not just the United States, but the entire world experienced some drastic changes ever since the Covid-19 pandemic took center stage. With business, jobs, and life itself on pause for almost a year, the inflation rate slowly became a large part of concern in the lives of Americans. Many economists have predicted that ‘stagflation’ will soon come to fruition with almost every major aspect of the economy reaching larger than expected deficits. With so much worry and concern, many investors have been resorting to precious metals like gold and silver to preserve their investment and grow their assets. Allegiance Gold has been educating about the importance of diversifying a financial portfolio into precious metals for years now. After this article on stagflation, make sure to contact one of our executives for an exclusive offer that can benefit your retirement.

What Is Stagflation?

Stagflation is defined as an economic event where inflation soars higher than expected, the economic growth rate slows, and unemployment significantly increases as well. This type of combination is not a favorable combination and is feared by the government as it may ultimately worsen the inflation rate.

What Causes Stagflation?

Stagflation usually is caused by either two factors, poor economic conditions or rapid economic increases. Poor economic conditions can be related to poor policies within the government that create harm to industries while growing the money supply too quickly. A good example of this is when there is slow economic growth and higher inflation rates. Rapid economic increases are when there is a sudden increase in oil or local commodities. These two factors usually coexist with one another in order for stagflation to occur.

History of Stagflation in the United States

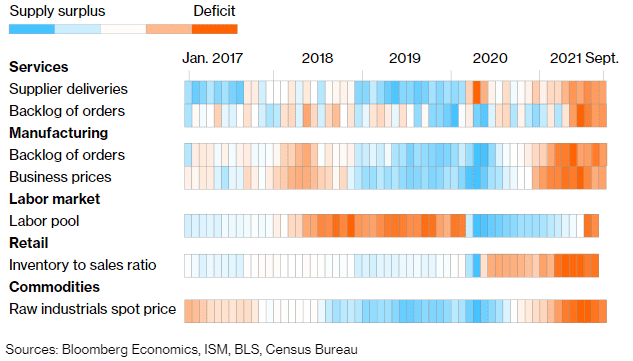

Stagflation has not been that common in the United States, as is it a rare term to most Americans. The last time that stagflation occurred was when President Richard Nixon was in office. The year was 1971 and President Nixon took the U.S. off the gold standard, which resulted in the decline of the dollar and significantly raised inflation prices. Skyrocketing oil prices and soaring unemployment rates added to the mix helped economists place the term ‘stagflation’ upon the government at this time. In the spring of 2021, the resurgence of stagflation started to brew among economists. With the rollout of coronavirus vaccines, it created a high demand for vaccines as shortages in the supply chain, unemployment rates rose, and inflation was higher than before. Although stagflation has not yet been declared in the nation, it does seem that it is inevitable at this point with the direction the economy is heading.

With stagflation on the cusp of occurring, what can you do as an investor to safeguard your money? Turn to Allegiance Gold to help educate you on the current events, as well as, the importance of diversifying a financial portfolio into precious metals. Precious metals like gold and silver, have had amazing returns and growth in both the years 2020 and 2021. Call the executives at Allegiance Gold today to learn more at 844-790-9191. Make sure to ask about receiving your FREE gold IRA guide!

Request our FREE investment guide to uncover insider tips and strategies for protecting your wealth.

REFERENCE:

https://www.bloomberg.com/news/features/2021-11-02/supply-chain-crisis-has-central-banks-facing-stagflation-lite

Custom Precious Metals IRA

Custom Precious Metals IRA